Fred Hickey's Tweets: Decoding Tech Strategy With Economic Data

In the fast-paced world of technology and finance, staying ahead requires more than just intuition; it demands a deep understanding of underlying economic currents. For many, following the insights of seasoned strategists like Fred Hickey has become an essential part of their information diet. His succinct yet profound observations, often shared through his latest tweets, frequently touch upon the intricate relationship between macroeconomic trends and the performance of the tech sector. This article delves into how a renowned tech strategist like Fred Hickey leverages robust economic data, particularly from authoritative sources like the Federal Reserve Economic Data (FRED) database, to formulate and disseminate his valuable market perspectives.

Understanding the nuances of economic indicators is crucial for anyone navigating the complexities of modern markets. Fred Hickey, a name synonymous with insightful tech analysis, consistently demonstrates how a meticulous approach to data can illuminate future market trajectories. His commentary serves as a testament to the power of integrating comprehensive economic understanding with specific industry knowledge, offering a roadmap for investors and enthusiasts alike.

The Intersection of Tech Strategy and Economic Reality

The tech sector, often perceived as a world apart, is in fact deeply intertwined with the broader economy. Factors like consumer spending, interest rates, inflation, and global trade directly impact technology companies' revenues, profitability, and innovation cycles. A strategist like Fred Hickey understands that a booming tech stock might be a house of cards if the economic foundation it rests upon is crumbling. Conversely, robust economic growth can provide tailwinds for even struggling tech firms. This symbiotic relationship necessitates a constant vigil over economic data, making it an indispensable tool for any serious tech analyst.

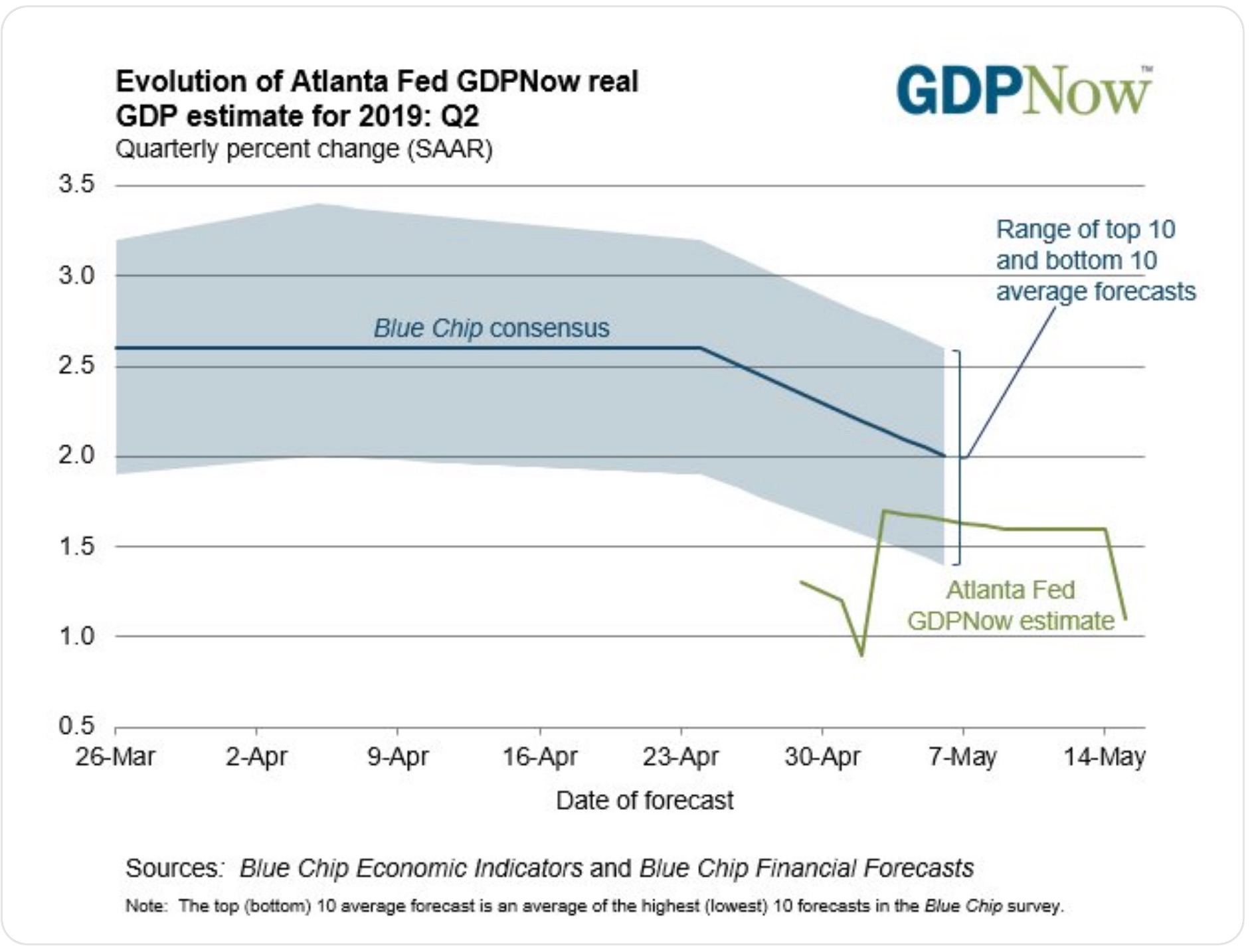

For instance, a shift in the federal funds rate, a key economic indicator, can significantly alter the cost of capital for tech companies, impacting their ability to fund research and development or expand operations. Similarly, changes in Gross Domestic Product (GDP), a primary measure of economic output, directly reflect the health of the economy and, by extension, consumer and business demand for technology products and services. These are the kinds of vital statistics that inform the insights shared by experts like Fred Hickey, often condensed into his latest tweets for a broad audience.

Who is Fred Hickey? A Profile of the Tech Strategist

Fred Hickey is widely recognized as a veteran technology strategist and editor of "The High-Tech Strategist" newsletter, which has provided independent analysis of the technology sector for decades. He is known for his deep fundamental research, often taking contrarian views, and his ability to identify long-term trends and potential pitfalls in the tech industry. His insights are highly valued by institutional and individual investors seeking an edge in the volatile tech market. While specific personal details are not publicly emphasized, his professional career speaks volumes about his dedication and expertise.

Professional Background and Investment Philosophy

Fred Hickey's career has been marked by a consistent focus on understanding the intricate dynamics of the technology industry. His investment philosophy often emphasizes value and a keen eye for unsustainable trends or bubbles. He is known for his detailed analysis of company financials, competitive landscapes, and technological shifts. His ability to synthesize complex information and present it in an accessible manner, often through his influential newsletter and more recently via his latest tweets, has cemented his reputation as a trusted voice. He frequently references broader economic conditions, understanding that even the most innovative tech company operates within a larger economic framework.

Fred Hickey: Professional Overview

| Attribute | Detail |

|---|---|

| Primary Role | Technology Strategist, Editor of "The High-Tech Strategist" |

| Focus Area | In-depth analysis of the technology sector, identifying long-term trends and value opportunities. |

| Key Characteristics | Independent, contrarian views, fundamental research-driven, value-oriented. |

| Communication Channels | Newsletter ("The High-Tech Strategist"), Social Media (e.g., Twitter for latest tweets). |

| Influence | Highly regarded by investors for his insights into tech market dynamics and economic interplay. |

The Power of Data: Why Economic Indicators Matter for Tech

Economic indicators are the pulse of the economy. For a tech strategist like Fred Hickey, monitoring these indicators is not just an academic exercise; it's a critical component of risk assessment and opportunity identification. Consider Gross Domestic Product (GDP), the featured measure of U.S. output, which represents the market value of the goods and services produced by labor and capital. A robust GDP indicates a healthy economy, which typically translates to higher corporate earnings, including those in the tech sector. Conversely, a slowdown in GDP growth can signal reduced demand for everything from smartphones to enterprise software, directly impacting tech company valuations.

Beyond GDP, other indicators like inflation rates, employment figures, consumer confidence, and manufacturing indices provide a holistic view of economic health. The federal funds rate, for example, directly influences borrowing costs for businesses and consumers, affecting everything from venture capital funding for startups to consumer loans for purchasing tech gadgets. These are the data points that form the bedrock of informed analysis, enabling strategists to contextualize company-specific news within the broader economic landscape, a perspective often reflected in Fred Hickey's latest tweets.

FRED: The Unsung Hero of Economic Analysis

When it comes to reliable and comprehensive economic data, the Federal Reserve Economic Data (FRED) database stands out as an indispensable resource. It's a goldmine for anyone looking to understand the economy, from academics to professional strategists like Fred Hickey. The ability to download, graph, and track hundreds of thousands of economic time series from numerous sources makes it unparalleled. For a strategist dissecting the market, FRED provides the raw material for deep insights.

Navigating the FRED Database: A Wealth of Information

The FRED database is a testament to transparency and accessibility in economic data. Users can download, graph, and track over 827,000 economic time series from 117 sources. This vast collection includes everything from granular details like 392 economic data series for specific MSAs (Metropolitan Statistical Areas) like Tucson, AZ, to broad national indicators like GDP and the federal funds rate. For a strategist, this breadth allows for both macro-level analysis and targeted regional or sectoral investigations. The tools and resources available within FRED make it easy to find and use economic data worldwide, facilitating the rigorous analysis that underpins expert commentary, including Fred Hickey's latest tweets.

The database offers a historical perspective, allowing analysts to trace financial, economic, and banking history through decades of compiled data. This historical context is vital for identifying long-term trends and cycles, which are often more predictive than short-term fluctuations. For example, understanding past responses of the tech sector to changes in the federal funds rate or GDP growth can provide valuable clues for future performance.

Understanding Data Vintages and Revisions

A crucial feature of the FRED database, and one that highlights its precision, is its handling of data revisions. The FRED database always contains and displays the most recent revision—or vintage—of the data available. This is incredibly important because economic data is often revised as more complete information becomes available. For instance, an initial estimate of GDP might be revised months later. For an analyst, relying on the most current vintage ensures that their conclusions are based on the most accurate information possible. This meticulous attention to data quality is what separates robust analysis from mere speculation, a principle that guides the work of strategists like Fred Hickey.

Understanding these vintages of economic data is key to accurate historical analysis and forecasting. A strategist might analyze how initial data releases impacted market sentiment versus how the revised data changed the long-term economic picture. This level of detail is essential for providing authoritative and trustworthy insights.

Deconstructing Fred Hickey's Latest Tweets: Data-Driven Insights

Fred Hickey's latest tweets often serve as concise distillations of his extensive research and economic analysis. While a tweet's character limit necessitates brevity, the underlying insights are typically rooted in a deep understanding of economic data, much of which can be sourced from FRED. For example, a tweet might highlight concerns about tech valuations in the context of rising interest rates, implicitly referencing the federal funds rate data. Another might point to a slowdown in enterprise spending, drawing on GDP figures or manufacturing indices.

His tweets are not just opinions; they are often conclusions drawn from careful examination of trends, historical precedents, and current economic realities. When Fred Hickey shares his perspective, it's often informed by the same comprehensive data that is available for download, graph, and track from the FRED database. This makes his commentary particularly valuable, as it provides a framework for others to conduct their own due diligence, encouraging informed decision-making rather than speculative trading. His ability to connect complex economic data to tangible impacts on tech companies is a hallmark of his expertise.

The E-E-A-T and YMYL Imperative in Financial Commentary

In the realm of financial advice and market commentary, adherence to E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) principles is paramount. When a strategist like Fred Hickey shares his latest tweets, he is operating within this high-stakes environment. His long-standing career, consistent track record, and deep dive into economic data (like that from FRED) contribute significantly to his perceived expertise and authoritativeness. Investors trust his insights because they are built on a foundation of rigorous analysis and experience, not fleeting trends or unsubstantiated claims.

For YMYL topics, which directly impact a person's financial well-being, the source of information must be unimpeachable. The reliance on verifiable, comprehensive data from sources like FRED bolsters the trustworthiness of financial commentary. When Fred Hickey provides a perspective on the tech market, it's understood that his views are informed by a careful study of economic fundamentals, providing a more reliable basis for investment decisions than casual speculation. This commitment to data-driven insights is what makes his contributions so valuable to the investment community.

Beyond the Numbers: The Broader Landscape of "Freds"

While our focus remains squarely on the economic data from FRED and the insights from strategist Fred Hickey, it's worth acknowledging that the name "Fred" and "Fred's" appears in various other contexts, illustrating the diverse tapestry of American life. These mentions, while not directly related to financial strategy or economic data analysis, paint a broader picture of the name's prevalence in different spheres.

Diverse Roles, Shared Name: From Local Landmarks to Legal Experts

For instance, "Fred's Arena Bar & Steakhouse, located at 9650 S Avra Rd, Tucson, Arizona," stands as a vibrant local establishment, offering a range of services and highlights to please all guests. It's a place where "Steakhouse, hamburgers, thin crust pizza, full bar" are enjoyed, attracting 3,209 likes, 5 people talking about it, and 6,982 visits. Described as being "off the two lane highway, down a rough and rugged paved road, then onto a dirt road into what looks like a ranching community, and down the road a piece on the corner, you'll find Fred's," it offers a distinct, welcoming atmosphere, much like "Ty's is a fantastic steakhouse with delicious food, friendly service, and a fun atmosphere." These establishments are integral parts of their local communities, providing gathering places and culinary experiences.

Beyond hospitality, the name "Fred" also surfaces in other professional and historical contexts. We find mentions of individuals like "Fred Adler, raised in Youngstown, Ohio," a proud father with over "35 years of experience in the insurance" industry. Similarly, the "Fred Archer neighborhood center" in an area first settled by African American homesteaders in the 1930s and 1940s, speaks to community development and historical roots. While these "Freds" and "Fred's" contribute to their respective fields—be it local entertainment, insurance, or community history—they stand apart from the economic data analysis that defines the work of FRED (the database) and Fred Hickey (the strategist). These diverse uses of the name simply highlight its commonality across various facets of society, without direct bearing on the complex financial insights that are the core of this discussion.

Empowering Your Investment Decisions with Informed Analysis

In a world saturated with information, discerning credible and actionable insights is paramount. The work of strategists like Fred Hickey, particularly when informed by robust economic data from sources like FRED, offers a beacon of clarity. His latest tweets, while brief, often encapsulate years of experience and deep analytical rigor. By understanding the economic underpinnings of his commentary, investors can move beyond mere speculation and make more informed decisions. The ability to download, graph, and track economic data from FRED empowers individuals to verify, explore, and deepen their own understanding of the market forces at play.

Whether it's the nuances of GDP, the implications of the federal funds rate, or the significance of data vintages, these economic indicators are the bedrock of sound financial strategy. Fred Hickey exemplifies how to translate complex economic realities into actionable insights for the tech sector, making his contributions invaluable to those seeking to navigate the investment landscape with greater confidence and knowledge.

Conclusion: The Enduring Value of Expert Economic Insight

The journey through the world of economic data and its application in tech strategy underscores the profound importance of informed analysis. Fred Hickey, through his dedicated work and insightful commentary, including his latest tweets, demonstrates how a deep understanding of economic indicators, particularly those accessible through the comprehensive FRED database, is indispensable for navigating the complexities of the technology market. From tracking 827,000 economic time series to understanding the impact of GDP and the federal funds rate, the integration of macroeconomics with sector-specific knowledge provides a powerful lens for investment decisions.

In an era where financial markets are increasingly interconnected with global economic shifts, the expertise of strategists who meticulously analyze data is more valuable than ever. We encourage readers to explore the wealth of information available in the FRED database for themselves, and to critically engage with the data-driven insights shared by experts like Fred Hickey. By doing so, you can empower your own investment journey with knowledge, fostering a more robust and resilient approach to the ever-evolving financial landscape. What economic data points do you find most crucial for your investment decisions? Share your thoughts and join the conversation below!

Fred Hickey: 2024 "Going To Be A Lot Worse" For Markets As Tech Stocks

Fred Hickey On The Takedown In The Gold Market And Fed Comments | King

Tech is not necessarily going to get hurt more than the broader market