Unveiling Chase: Where Does This Financial Powerhouse Originate?

The question "where is Chase Matthew from" often sparks curiosity, leading many to wonder about the origins and vast reach of one of the world's most prominent financial institutions. While the name "Chase Matthew" might conjure images of a specific individual for some, in the broader context of finance, it points directly to Chase, a banking giant whose presence is felt across the globe and deeply integrated into the daily lives of millions. Understanding where Chase originates from isn't just about pinpointing a single geographical location; it's about tracing the evolution of a financial entity that has grown to serve a diverse array of needs, from individual banking to complex corporate solutions.

This comprehensive exploration delves into the foundational roots of Chase, examining its historical journey, its expansive physical and digital footprint, and the core principles that have allowed it to become a cornerstone of the global economy. We will uncover how Chase has evolved from its early beginnings to a modern banking powerhouse, accessible through a myriad of channels, from local branches and ATMs to sophisticated online and mobile platforms. By the end of this article, readers will have a clear understanding of not just "where Chase Matthew is from" in terms of its operational base, but also how its services and security measures make it a trusted financial partner for millions worldwide.

Table of Contents

- The Foundational Roots of Chase: A Historical Glimpse

- Chase's Expansive Geographic Footprint: Beyond Borders

- The Core Offerings: Products and Services That Define Chase

- Seamless Transactions: Convenience at Your Fingertips

- Security and Trust: The Pillars of Chase's Operations

- Accessibility for Millions: How Chase Reaches You

- Navigating the Digital Landscape: Terms and Policies

- The Future of Banking: Chase's Ongoing Evolution

The Foundational Roots of Chase: A Historical Glimpse

To truly understand "where Chase Matthew is from" in the context of this financial powerhouse, we must delve into its rich history. Chase, as we know it today, is the result of numerous mergers and acquisitions, with its earliest roots tracing back to the Manhattan Company, founded in 1799 by Aaron Burr. This initial venture was primarily established to provide clean water to New York City but also included banking powers, which eventually became its sole focus. Over the centuries, this entity, through various transformations, evolved into what would become Chase Manhattan Bank. Another significant lineage comes from J.P. Morgan & Co., founded in 1871, a titan in investment banking. The pivotal merger of Chase Manhattan Corporation and J.P. Morgan & Co. in 2000 created JPMorgan Chase & Co., a global financial services holding company and one of the largest banks in the United States and the world. This extensive history, spanning over two centuries, underscores the deep-seated origins and continuous evolution that define Chase's identity today. It’s not just a bank; it’s a legacy of financial innovation and adaptation, constantly expanding its reach and capabilities to serve millions of people with a broad range of products.

Chase's Expansive Geographic Footprint: Beyond Borders

When considering "where is Chase Matthew from," one might initially think of a single headquarters. While JPMorgan Chase & Co. is headquartered in New York City, the operational footprint of Chase Bank extends far beyond this single location, demonstrating a truly national and, in some respects, global presence. Chase has strategically established a vast network that ensures accessibility for its diverse customer base, whether they prefer traditional in-person banking or cutting-edge digital solutions. This dual approach to presence—physical and digital—is key to understanding its pervasive reach.

Physical Presence: Branches and ATMs Across the Nation

Chase maintains a robust physical presence across the United States, with thousands of branches and ATMs strategically located in major cities and suburban areas. This extensive network allows customers to engage in traditional banking activities, from opening accounts to seeking financial advice. For instance, you can easily find a Chase branch and ATM in Plano, Texas, or any other city by simply using their online locator. These physical locations are more than just transaction points; they are community hubs where customers can get location hours, directions, customer service numbers, and access available banking services. The ability to find an ATM or branch near you by simply entering a zip code, or address, city, and state, highlights Chase's commitment to making banking convenient and accessible, irrespective of where a customer might be located within its operational territories.

The Digital Frontier: Chase Online and Mobile Banking

In an increasingly digital world, Chase's online and mobile platforms are arguably its most significant "location" for millions of users. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills, or transfer funds securely from one account to another, all from the comfort of your home or on the go. This digital accessibility means that for many, "where is Chase Matthew from" becomes less about a physical address and more about the seamless connectivity offered by their digital services. The Chase Mobile® app exemplifies this, allowing users to bank securely, send and receive money with Zelle®, deposit checks, monitor credit scores, budget, and track income & spend. These digital tools ensure that Chase's services are available 24/7, transcending geographical boundaries and providing unparalleled convenience to its vast customer base.

The Core Offerings: Products and Services That Define Chase

Beyond its physical and digital presence, the essence of "where Chase Matthew is from" also lies in the comprehensive suite of products and services it offers. Chase serves millions of people with a broad range of products designed to meet diverse financial needs, from everyday banking to long-term investment strategies. This extensive portfolio is a testament to its commitment to being a full-service financial partner for individuals, families, and businesses alike. Understanding these offerings provides deeper insight into the functional origin of Chase's utility and value in the market.

Tailored Checking Solutions: Meeting Diverse Needs

One of Chase's foundational offerings is its array of checking accounts, each designed to cater to specific customer requirements. You can learn about the benefits of a Chase checking account online and compare Chase checking accounts to select the one that best fits your needs. A standout option is Chase Secure Banking℠, a checking account with no overdraft fees and no fees on most everyday transactions. This particular product highlights Chase's commitment to transparent and customer-friendly banking, allowing individuals to pay bills, cash checks, and send money with peace of mind, knowing they won't incur unexpected charges. The variety ensures that whether you're a student, a professional, or managing a household budget, Chase has a checking solution tailored for you, emphasizing its role as a versatile financial provider.

Seamless Transactions: Convenience at Your Fingertips

A key aspect of Chase's operational philosophy, and a significant part of "where Chase Matthew is from" in terms of its service delivery, is its unwavering focus on convenience. The bank has invested heavily in technologies and services that make financial transactions effortless and accessible from virtually anywhere. This commitment to convenience is evident in its various deposit methods and payment systems, which empower customers to manage their finances efficiently without being tied to traditional banking hours or locations.

Advanced Deposit Methods: QuickDeposit and ATM Capabilities

Chase has revolutionized how customers deposit funds, offering multiple secure and convenient options. Chase QuickDeposit℠ allows you to securely deposit checks from anywhere using your mobile device, eliminating the need to visit a branch or ATM. For those who prefer physical deposits, Chase ATMs are incredibly versatile, conveniently allowing you to deposit up to 30 checks and cash at most ATMs, often without an envelope. Furthermore, direct deposit automatically deposits your paychecks or other recurring payments directly into your account, streamlining your finances and ensuring immediate access to your funds. These advanced methods underscore Chase's dedication to leveraging technology to enhance the customer experience, making banking simpler and more integrated into daily life.

Security and Trust: The Pillars of Chase's Operations

In the realm of finance, trust is paramount. For Chase, ensuring the security of its customers' assets and personal information is not just a feature but a fundamental principle that defines "where Chase Matthew is from" in terms of its operational integrity. The bank employs robust security measures across all its platforms, from physical branches to its sophisticated digital infrastructure, to protect against fraud and unauthorized access. This unwavering commitment to security is a core reason why millions entrust their financial well-being to Chase.

Every transaction, whether online, via mobile, or at an ATM, is safeguarded with advanced encryption and fraud monitoring systems. Chase's secure banking environment extends to its mobile app, where features like biometric login and real-time alerts provide an additional layer of protection. The emphasis on security is consistently communicated to users, reminding them to always review terms, privacy, and security policies to understand how they apply to their interactions. This proactive approach to security, combined with continuous technological advancements, reinforces Chase's position as a reliable and trustworthy financial institution.

Accessibility for Millions: How Chase Reaches You

The answer to "where is Chase Matthew from" also lies in its pervasive accessibility, making its services available to a vast and diverse population. Chase's strategy revolves around providing multiple touchpoints, ensuring that customers can access their banking services in the way that best suits their lifestyle. This multi-channel approach is crucial for a financial institution that serves millions of people with a broad range of products, catering to varying preferences for interaction.

Beyond the physical presence of branches and ATMs, the digital realm offers unparalleled accessibility. The Chase Mobile® app, for instance, transforms your smartphone into a portable bank branch. With it, you can effortlessly send and receive money with Zelle®, a popular peer-to-peer payment service, deposit checks using just your phone's camera, and even monitor your credit score to stay on top of your financial health. The app also empowers users to budget and track income & spend, offering a comprehensive suite of financial management tools at their fingertips. This digital convenience means that whether you're at home, at work, or traveling, Chase's services are just a tap away, solidifying its position as a truly accessible financial partner for modern life.

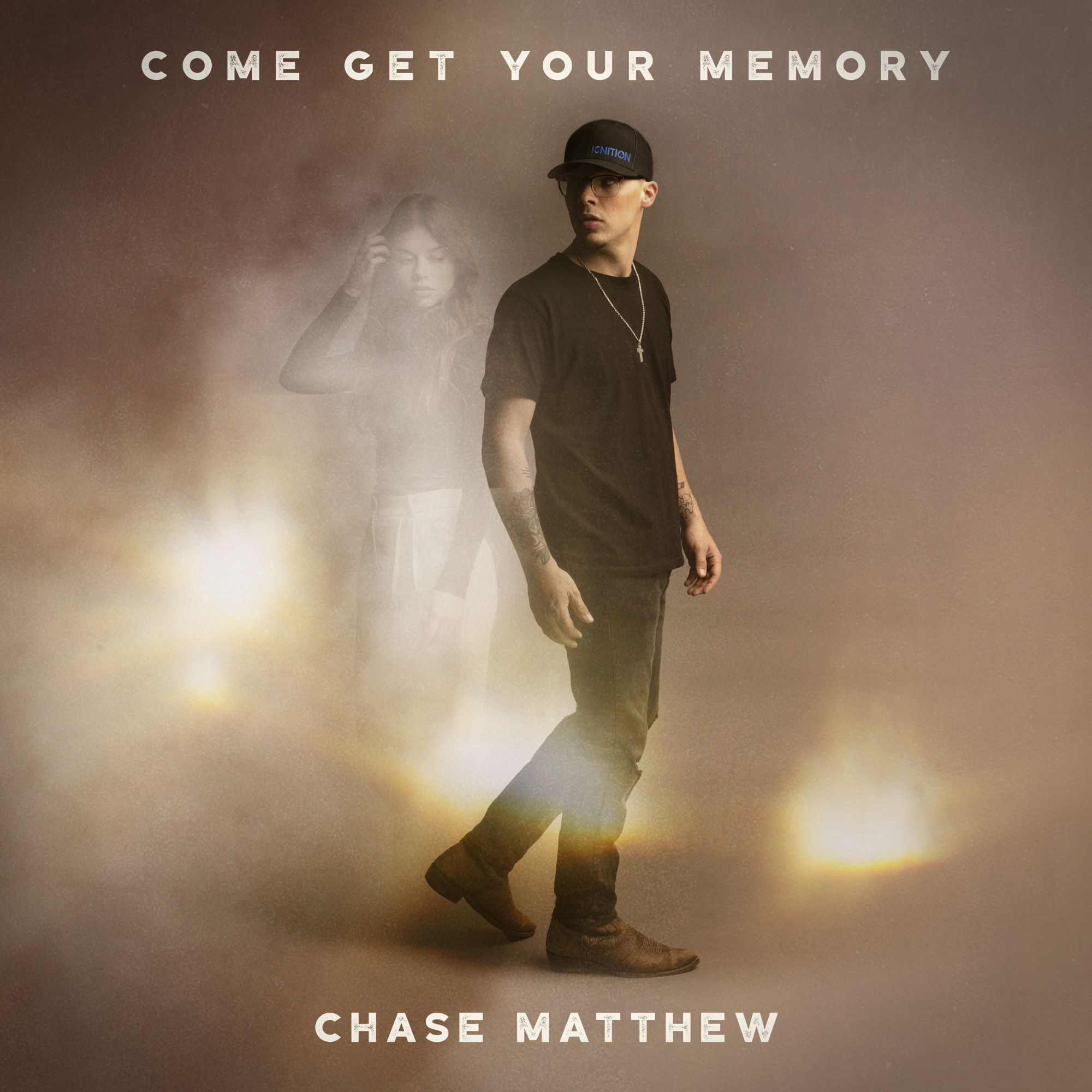

Chase Matthews

Chase Matthews Then And Now

Chase Matthew Wallpapers - Wallpaper Cave