Streamlining Compliance: The Power Of Tyler Insurance Filings

Table of Contents:

- Introduction: Navigating the Complex World of Insurance Filings

- Demystifying "Tyler": Beyond the City and the Creator

- What is Tyler Insurance Filings? A Core Solution for Regulatory Compliance

- Key Features and Functionalities: Empowering Efficiency

- State Partnerships and Impact: A Network of Trust

- Enhancing Operational Efficiency: The Business Advantage

- Why Compliance Matters: The YMYL Context of Insurance Filings

- The Future of Insurance Filings: Innovation and Adaptation

- Conclusion: Securing the Future of Insurance Compliance

Introduction: Navigating the Complex World of Insurance Filings

In the intricate landscape of regulatory compliance, insurance companies and motor carriers face a formidable challenge: managing a myriad of essential filings with precision and timeliness. The sheer volume and complexity of these requirements can overwhelm even the most diligent organizations, leading to potential errors, delays, and costly penalties. This is where specialized solutions become indispensable, transforming a daunting task into a manageable process.

Among the critical tools designed to alleviate this burden, Tyler Insurance Filings stands out as a robust platform engineered to simplify and streamline the often-arduous process of submitting vital insurance documentation. Far from being a mere digital mailbox, this system is a comprehensive ecosystem built for accuracy, efficiency, and unwavering adherence to state-specific regulations. Understanding its capabilities is crucial for any entity operating within the highly regulated insurance sector, where every filing holds significant financial and operational implications.

Demystifying "Tyler": Beyond the City and the Creator

Before delving into the specifics of Tyler Insurance Filings, it's essential to clarify the identity of "Tyler" in this context. The name "Tyler" is associated with several prominent entities, which can sometimes lead to confusion. There's Tyler, Texas, famously known as the "Rose Capital of America," a vibrant city with a rich history, charming brick streets, and a highly-rated school district, Tyler ISD. This city is also home to the Tyler Area Chamber of Commerce, boasting over 2,000 business organizations. Then, there's Tyler Gregory Okonma, professionally known as Tyler, The Creator, an influential American rapper, singer, and record producer.

However, when we discuss Tyler Insurance Filings, we are referring to a distinct entity: a provider of public sector software solutions. This "Tyler" is dedicated to meeting the unique needs of state, local, and federal government organizations, as well as school districts. This broader "Tyler" company develops specialized software designed to improve governmental operations, from water utility management to, crucially, regulatory compliance for the insurance industry. It's this specific arm of the "Tyler" enterprise that has developed the powerful platform we are exploring today, a solution headquartered at 4201 Wilson Boulevard, Suite 510.

What is Tyler Insurance Filings? A Core Solution for Regulatory Compliance

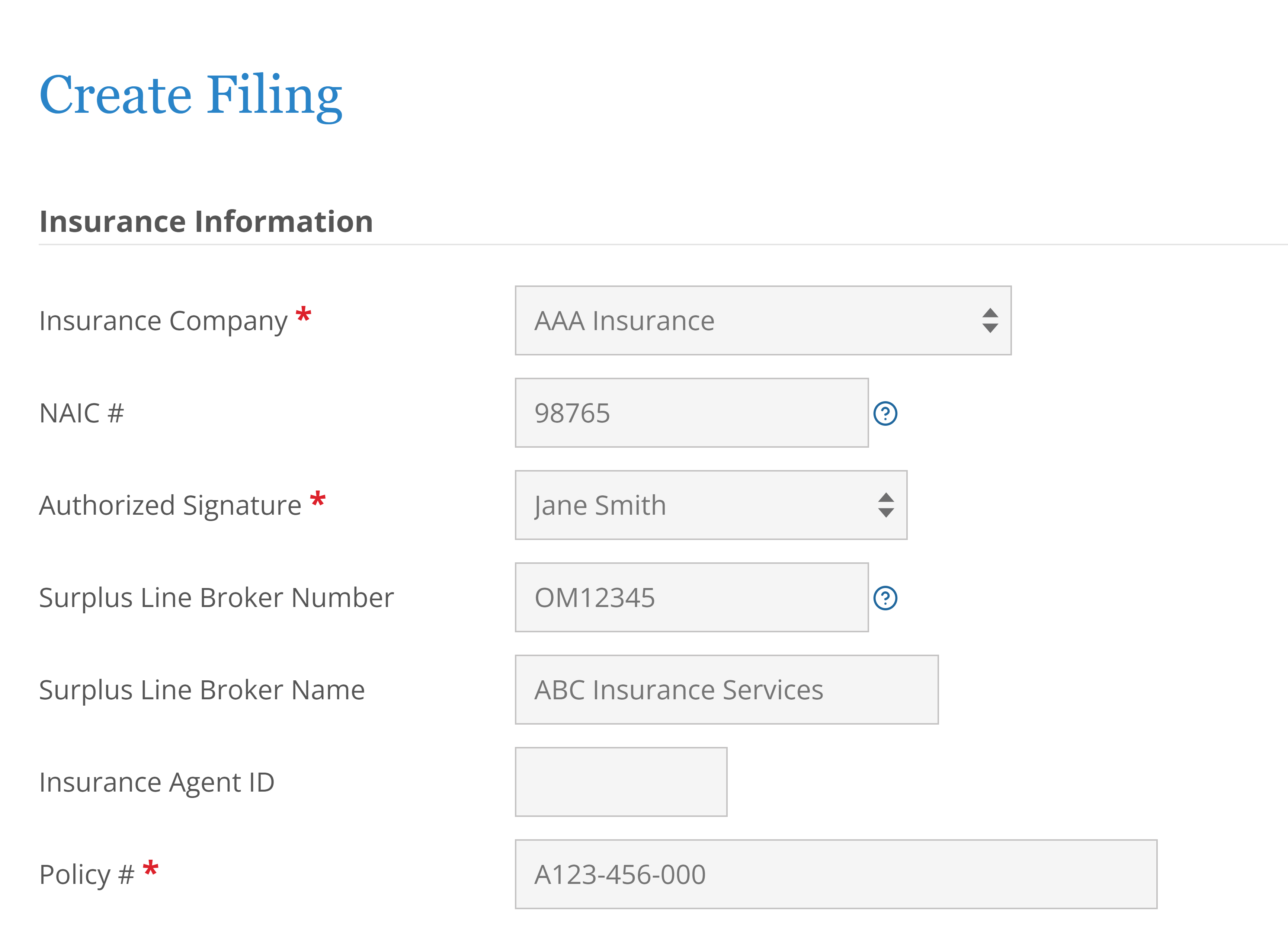

Tyler Insurance Filings is an advanced online platform specifically designed to facilitate the submission of essential insurance forms for companies and motor carriers. Its primary objective is to simplify the often-complex filing process, ensuring accuracy, compliance, and operational efficiency. In an industry where timely and correct submissions are paramount, this system acts as a critical bridge between insurance entities and regulatory bodies.

The platform is built on the understanding that regulatory compliance is not just about meeting minimum requirements; it's about maintaining operational integrity and financial stability. By offering an easy and efficient way to create and file 18 essential insurance forms, covering a wide range of requirements, Tyler Insurance Filings helps companies stay ahead of the curve in a constantly evolving regulatory landscape. It is committed to providing solutions that streamline operations and increase efficiency in managing critical insurance filings, particularly for those on behalf of motor carriers.

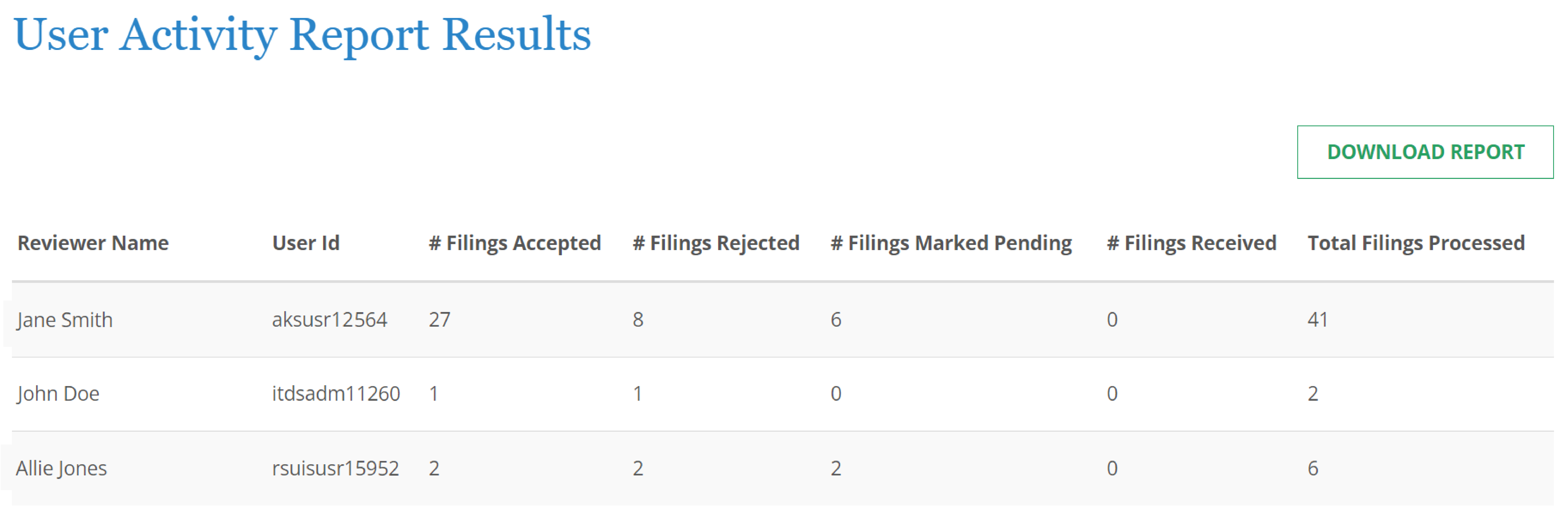

This commitment extends to continuously improving and expanding functionality for its users. The team behind Tyler Insurance Filings actively seeks suggestions for enhancements, demonstrating a user-centric approach to development. This collaborative philosophy ensures that the platform evolves in direct response to the real-world needs and challenges faced by insurance professionals navigating the complexities of motor carrier insurance filings and other regulatory demands.

Key Features and Functionalities: Empowering Efficiency

The strength of Tyler Insurance Filings lies in its comprehensive suite of features, all geared towards simplifying and enhancing the filing experience. These functionalities address common pain points faced by insurance companies and motor carriers, from reducing manual data entry to ensuring timely renewals.

Comprehensive Form Coverage

One of the most significant advantages of Tyler Insurance Filings is its extensive catalog of supported forms. The platform offers an easy and efficient way to create and file 18 essential insurance forms, covering a wide range of requirements. This broad coverage ensures that users can manage diverse filing needs from a single, centralized system. Key forms include:

- Motor Carrier Forms: The system allows for the filing of forms E, H, and K for motor carriers, particularly those with vehicles holding 10 or fewer passengers. These forms are critical for demonstrating financial responsibility and compliance, and the platform offers tips for filing them correctly.

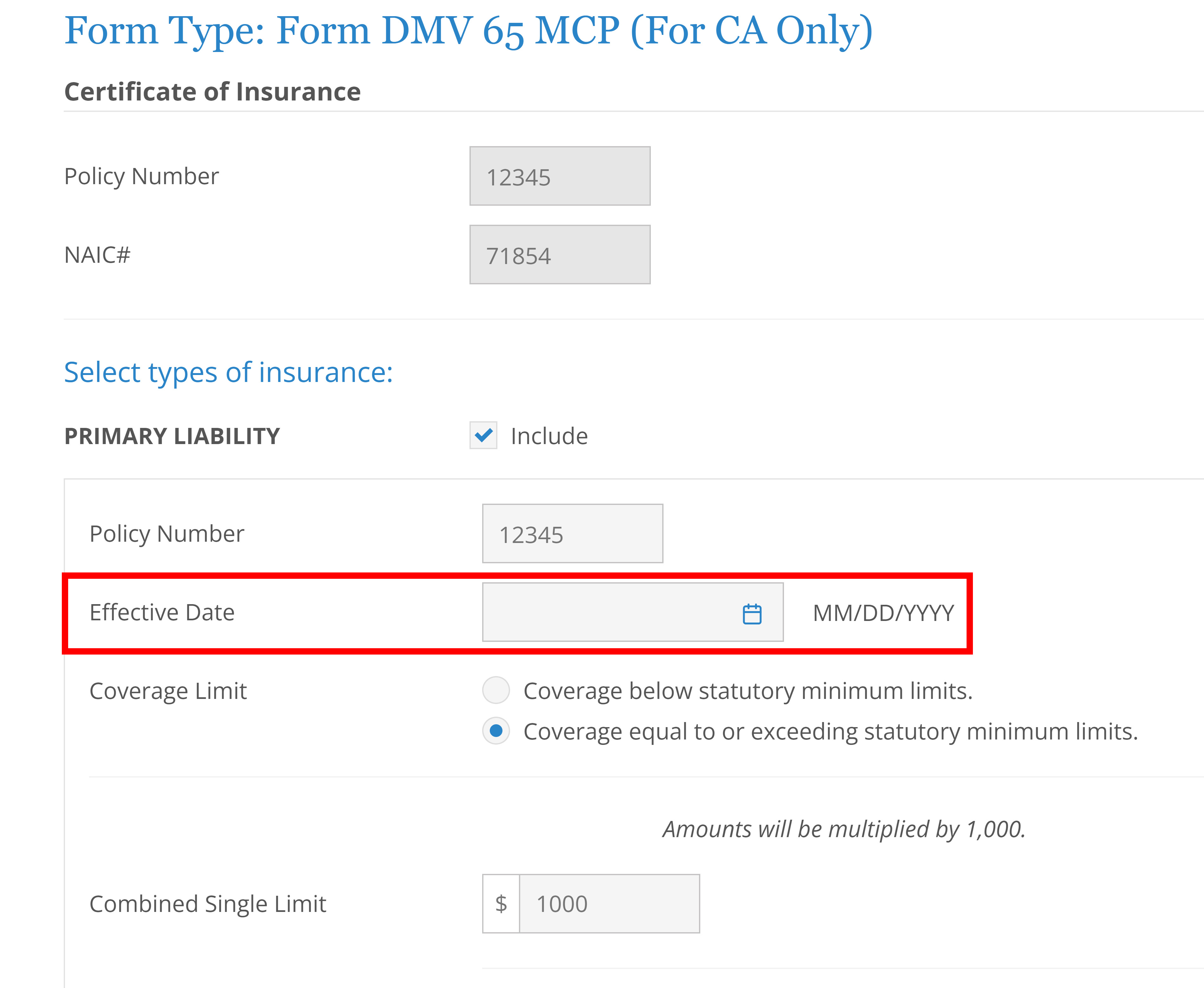

- California-Specific Filings: Recognizing the unique requirements of states like California, Tyler Insurance Filings has expanded its catalog to include the California Department of Motor Vehicles REG 1324 form (Private Carrier of Passengers Insurance Policy Endorsement). Furthermore, it provides robust support for California MCP 65 filings, a crucial requirement for motor carrier permits.

- SR22 and SR26 Forms: For states like Maine, the platform now enables insurance companies to file SR22 and SR26

2022 Quarter 1 Newsletter | Tyler Insurance Filings

California MCP 65 reinstatement filing simplified | 2022 Quarter 3

2023 Quarter 1 Newsletter | Tyler Insurance Filings