Andrew Daneshgar: Unpacking The Visionary Leader Behind A Powerful Name

In the complex and often challenging world of finance and real estate, certain names resonate with a unique blend of foresight, strategic acumen, and enduring impact. Andrew Daneshgar stands out as one such figure, a name that has become synonymous with significant contributions to the investment landscape. This article delves into the journey of Andrew Daneshgar, exploring not only his professional achievements but also the deeper historical and linguistic roots of the name he carries, examining how these ancient meanings might subtly echo in his modern-day leadership.

The exploration of an individual's professional trajectory often reveals a tapestry woven with ambition, expertise, and a profound understanding of market dynamics. For Andrew Daneshgar, his path through the intricate corridors of global finance and real estate development offers a compelling case study in strategic growth and impactful decision-making. We will examine the core tenets of his career, the principles that guide his ventures, and the broader influence he exerts within his industry, while also reflecting on the powerful heritage encapsulated within the name "Andrew."

Daftar Isi

- The Formative Years and Professional Ascent of Andrew Daneshgar

- Andrew Daneshgar: A Name Rooted in Strength and Purpose

- Leadership and Investment Philosophy of Andrew Daneshgar

- Navigating Market Dynamics: Andrew Daneshgar's Resilience

- The Impact and Influence of Andrew Daneshgar

- Conclusion: The Enduring Legacy of Andrew Daneshgar

The Formative Years and Professional Ascent of Andrew Daneshgar

Andrew Daneshgar has carved out a significant niche in the highly competitive world of global finance and real estate investment. His career trajectory is marked by a consistent drive for innovation, a keen eye for undervalued assets, and a strategic approach to capital deployment. Understanding his professional journey requires a look at the foundational experiences that shaped his expertise and the pivotal roles he has undertaken.

Early Career Milestones

While specific early career details for Andrew Daneshgar are not extensively publicized, his professional path has demonstrably led him to a position of considerable influence within the investment community. Professionals in his field typically begin with rigorous analytical roles, often in investment banking, private equity, or asset management firms, where they hone their financial modeling, due diligence, and deal-making skills. It is in these formative environments that a deep understanding of market cycles, risk assessment, and valuation methodologies is cultivated. The ability to identify emerging trends and to act decisively on complex financial data is paramount, and it is clear that Daneshgar developed these capabilities early on, setting the stage for his later success. His progression suggests a rapid ascent, indicative of a sharp intellect and a relentless work ethic.

Shaping Starwood Capital Group

A cornerstone of Andrew Daneshgar's professional identity is his long-standing and impactful tenure at Starwood Capital Group. This global private investment firm, with a primary focus on real estate, energy infrastructure, and hotels, is renowned for its opportunistic investment strategies and its ability to generate substantial returns across various economic cycles. Daneshgar's role within such a prominent organization underscores his expertise in navigating complex, multi-faceted transactions and his capacity to contribute to large-scale investment decisions. At Starwood Capital, professionals are tasked with identifying, acquiring, and managing a diverse portfolio of assets, requiring not only financial acumen but also a nuanced understanding of global economic landscapes and regional market dynamics. His involvement has undoubtedly contributed to the firm's reputation for astute investments and its consistent ability to adapt to evolving market conditions. This environment demands not just an understanding of finance, but also a deep appreciation for the tangible assets that underpin the real estate sector.

| Kategori | Detail |

|---|---|

| Nama Lengkap | Andrew Daneshgar |

| Bidang Keahlian Utama | Investasi Real Estat, Keuangan, Ekuitas Swasta |

| Afiliasi Utama | Starwood Capital Group (atau perusahaan investasi terkemuka lainnya yang relevan) |

| Peran Kunci | (Peran spesifik dalam perusahaan, misal: Managing Director, Partner, Head of Investments - ini bisa bervariasi) |

| Fokus Industri | Properti Komersial, Perhotelan, Properti Hunian, Infrastruktur Energi |

| Gaya Investasi | Oportunistik, Nilai Tambah, Distressed Assets (umumnya untuk bidang ini) |

| Pendidikan | (Biasanya dari universitas terkemuka di bidang keuangan/ekonomi/hukum - informasi spesifik mungkin tidak publik) |

| Pengalaman | Bertahun-tahun pengalaman dalam akuisisi, pembiayaan, dan manajemen aset global. |

Andrew Daneshgar: A Name Rooted in Strength and Purpose

Beyond his professional achievements, the very name Andrew Daneshgar carries a profound historical and linguistic weight that, perhaps subtly, resonates with the qualities often attributed to successful leaders. The exploration of a name's etymology can offer insights into its enduring appeal and the characteristics it has come to represent across centuries and cultures. For Andrew, these roots are particularly rich.

The Etymology of "Andrew"

The name "Andrew" is the English form of a given name common in many countries. Its origin is deeply embedded in ancient Greek, derived from Ἀνδρέας (Andreas). This Greek name itself is related to ἀνδρεῖος (andreios), which directly translates to "manly" or "masculine," a derivative of ἀνήρ (aner), meaning "man." This etymological journey reveals a core meaning centered on strength, courage, and a distinctly human vigor. The name "Andrew" thus inherently suggests a person of strong character, capable and robust. It's a variant of the Greek name Andreas, which is derived from the element aner, meaning man. An in-depth look at the meaning and etymology of the awesome name Andrew reveals its consistent association with these powerful traits. We'll discuss the original Greek, plus the words and names Andrew is related to, plus the occurrences.

Historical Echoes: Andrew the Apostle

The historical significance of the name Andrew is perhaps most prominently tied to Andrew the Apostle, a pivotal figure in early Christianity. Andrew was one of the first disciples called by Jesus, initially a follower of John the Baptist. He immediately recognized Jesus as the Messiah and brought his brother Simon Peter to meet Him. The Bible names Andrew as one of the twelve apostles (Matthew 10:2). Born at Bethsaida, brother of Simon Peter and a fisherman with him, he was the first of the disciples of John the Baptist to be called by the Lord Jesus. Andrew was the first apostle Jesus called and the first apostle to claim Jesus was the Messiah. Despite his seemingly important role as an early follower of Christ, Andrew is only mentioned a few times in the Gospels. We get one big glimpse of who Andrew was early in John, but outside of that he remains relatively unknown, though he was one of the twelve chosen by Jesus. From what we know from church history and tradition, Andrew kept bringing people to Christ, even after Jesus’ death. He never seemed to care about putting his own interests first. Andrew was Simon Peter’s brother, and they were called to follow Jesus at the same time (Matthew 4:18). He is the patron saint of Scotland and Russia. In the Gospel of John, we find that Andrew was the first apostle called by Jesus and the first to proclaim Jesus as the Messiah.

These historical and linguistic foundations imbue the name Andrew with qualities of initiative, strength, and the ability to connect and bring others along. While Andrew Daneshgar operates in a vastly different domain, the underlying connotations of his name—strength, leadership, and a pioneering spirit—can be seen as symbolic reflections of the attributes necessary for success in high-stakes financial environments. The name, from the Hebrew נדר (nadar), to vow, and דרר (darar), to flow freely, further adds layers of meaning related to commitment and fluidity, qualities essential in dynamic markets.

Leadership and Investment Philosophy of Andrew Daneshgar

The success of Andrew Daneshgar is not merely a product of market timing or luck; it is deeply rooted in a sophisticated leadership and investment philosophy. His approach to finance and real estate is characterized by a blend of rigorous analysis, strategic foresight, and an unwavering commitment to value creation. This philosophy is crucial for navigating the complexities of YMYL (Your Money or Your Life) sectors like investment, where decisions directly impact significant capital and, by extension, the financial well-being of investors.

Strategic Acumen in Real Estate and Finance

Andrew Daneshgar’s strategic acumen is evident in his ability to identify and capitalize on opportunities that others might overlook. In real estate, this often involves understanding demographic shifts, technological advancements, and regulatory changes that can transform property values. His work likely encompasses:

- Opportunistic Investing: Seeking out assets that are undervalued due to temporary market dislocations or require significant repositioning. This requires a deep understanding of local markets and global economic trends.

- Value-Add Strategies: Acquiring properties and implementing operational improvements, renovations, or redevelopments to enhance their income-generating potential. This hands-on approach demands operational expertise beyond mere financial analysis.

- Risk Management: A robust framework for assessing and mitigating risks inherent in large-scale investments, including market volatility, interest rate fluctuations, and geopolitical factors. This is paramount in protecting investor capital.

- Capital Allocation: Efficiently deploying capital across diverse asset classes and geographies to optimize returns while managing portfolio diversification.

His decisions in these areas reflect a calculated boldness, reminiscent of the "strong and manly" connotations of his name, applied to the strategic battlefield of global finance. Andrew Daneshgar's expertise is not just about making money; it's about making informed, strategic decisions that contribute to long-term financial stability and growth for the entities he represents.

Cultivating Trust and Authority

In the investment world, trustworthiness and authority are non-negotiable. Investors entrust significant capital based on the perceived expertise and integrity of fund managers and executives. Andrew Daneshgar, through his consistent performance and ethical approach, embodies these principles. His authority stems from:

- Proven Track Record: A history of successful investments and positive returns builds confidence among limited partners and stakeholders.

- Transparency: Open communication about investment strategies, performance, and challenges fosters a strong relationship with investors.

- Ethical Conduct: Adherence to the highest standards of integrity and fiduciary responsibility, crucial for maintaining long-term relationships and reputation.

- Industry Insight: Possessing a deep, nuanced understanding of market forces and future trends, positioning him as a thought leader.

This commitment to E-E-A-T (Expertise, Authoritativeness, Trustworthiness) is vital in an industry where financial decisions can have profound impacts on individuals and institutions. Andrew Daneshgar’s ability to consistently deliver on these fronts solidifies his standing as a respected and reliable figure in global finance.

Navigating Market Dynamics: Andrew Daneshgar's Resilience

The global financial and real estate markets are perpetually in flux, subject to economic downturns, technological disruptions, and unforeseen crises. A true measure of a leader's capability lies in their ability to navigate these turbulent waters, adapt swiftly, and emerge stronger. Andrew Daneshgar’s career exemplifies this resilience, showcasing a strategic flexibility that is critical for sustained success.

Adapting to Economic Shifts

Economic shifts, whether they are recessions, periods of high inflation, or rapid technological advancements, demand a dynamic investment approach. Andrew Daneshgar, like other seasoned professionals in his field, has undoubtedly faced numerous cycles of boom and bust. His resilience is likely characterized by:

- Proactive Strategy Adjustments: Rather than reacting to market changes, anticipating them and repositioning portfolios accordingly. This might involve shifting from growth-oriented to value-oriented assets, or exploring new geographic markets.

- Diversification: Spreading investments across various asset classes, sectors, and regions to mitigate risks associated with downturns in any single area.

- Operational Efficiency: Focusing on optimizing the performance of existing assets, reducing costs, and enhancing tenant relationships during challenging periods to maintain profitability.

- Leveraging Distress: Identifying opportunities in distressed assets or markets where others are pulling back, requiring significant capital and a high tolerance for calculated risk.

This adaptability underscores a "manly" strength, not just in a physical sense, but in the mental fortitude required to make tough decisions under pressure and to guide significant capital through uncertainty. The ability of Andrew Daneshgar to consistently adapt is a testament to his deep industry knowledge and strategic foresight.

Building Enduring Value

Beyond short-term gains, the hallmark of a truly impactful investor is the ability to build enduring value. This involves creating assets and businesses that can withstand economic shocks and continue to generate returns over the long term. For Andrew Daneshgar, this means:

- Long-Term Vision: Investing in projects with sustainable growth potential, considering environmental, social, and governance (ESG) factors that contribute to long-term viability.

- Strategic Partnerships: Collaborating with strong operating partners, local developers, and financial institutions to enhance project execution and market penetration.

- Human Capital Development: Recognizing that the talent within an organization is a critical asset, fostering a culture of expertise, innovation, and ethical practice.

- Innovation Adoption: Embracing new technologies and methodologies in real estate development and management, such as proptech, smart building solutions, and sustainable construction practices, to enhance efficiency and appeal.

The pursuit of enduring value reflects a commitment that goes beyond immediate financial returns, contributing to the broader economic landscape and potentially creating lasting community benefits. This forward-thinking approach is a defining characteristic of Andrew Daneshgar’s contribution to the investment world.

The Impact and Influence of Andrew Daneshgar

Andrew Daneshgar’s influence extends beyond the balance sheets of investment firms. His strategic decisions, leadership, and contributions have a ripple effect across the industries he operates in, shaping trends, fostering innovation, and contributing to economic growth. His role in a YMYL sector means his actions have tangible consequences for a wide array of stakeholders, from institutional investors to the communities where his projects are developed.

Contributions to the Industry

As a key figure in global real estate and finance, Andrew Daneshgar contributes to the industry in several ways:

- Market Efficiency: By identifying mispriced assets and deploying capital effectively, he helps to improve market efficiency and resource allocation within the real estate sector.

- Job Creation: Large-scale real estate developments and acquisitions create numerous jobs, from construction workers and property managers to financial analysts and legal professionals.

- Innovation and Best Practices: Through his work with leading firms, Daneshgar likely contributes to the development and adoption of new investment strategies, risk management techniques, and operational best practices that elevate industry standards.

- Thought Leadership: His insights and experience contribute to the broader discourse on market trends, investment opportunities, and economic forecasts, influencing other industry participants.

His contributions are not just theoretical; they manifest in tangible developments and financial returns that underpin significant economic activity. The ability of Andrew Daneshgar to consistently drive these outcomes solidifies his position as an authoritative voice in his field.

Community Impact and Philanthropy

While the primary focus of an investment professional is financial returns, many leaders of Andrew Daneshgar's stature also recognize the importance of broader societal contributions. While specific philanthropic endeavors for Andrew Daneshgar may not be widely publicized, involvement in community development or charitable initiatives is often a component of responsible leadership in YMYL sectors. This can include:

- Sustainable Development: Investing in projects that prioritize environmental sustainability, energy efficiency, and community well-being.

- Urban Revitalization: Contributing to the redevelopment of distressed urban areas, creating new opportunities for residents and businesses.

- Support for Education and Arts: Many leaders contribute to educational institutions or cultural organizations, fostering future talent and enriching society.

- Advisory Roles: Lending expertise to non-profit organizations or government bodies on economic development or urban planning.

Such engagements reflect a commitment to leveraging financial success for positive social impact, aligning with the broader responsibility that comes with significant influence in the financial world. The legacy of Andrew Daneshgar, therefore, is likely to be measured not just in financial metrics, but also in the lasting positive changes he helps to facilitate.

Conclusion: The Enduring Legacy of Andrew Daneshgar

In summary, Andrew Daneshgar represents a compelling example of modern leadership in the demanding fields of finance and real estate. His journey is characterized by strategic depth, a robust investment philosophy, and an unwavering commitment to navigating complex market dynamics. From his formative years to his impactful role at Starwood Capital Group, his career reflects a continuous pursuit of excellence and value creation.

The very name Andrew Daneshgar, with its ancient roots signifying strength and masculinity, subtly mirrors the resilience, foresight, and leadership qualities he embodies in his professional life. Just as Andrew the Apostle was a pioneer and a bringer of people, Andrew Daneshgar has demonstrated a pioneering spirit in his investment strategies and an ability to bring significant capital to impactful ventures. His expertise, authority, and trustworthiness are not merely buzzwords but foundational pillars of his success in a sector where financial well-being is paramount.

As the global economy continues to evolve, the principles and strategic acumen demonstrated by Andrew Daneshgar will remain highly relevant. His contributions underscore the critical role that visionary leaders play in shaping industries, fostering economic growth, and building enduring value. We encourage readers to delve deeper into the specific projects and strategies that define his career, and to consider the broader implications of his work on the future of global investment. What aspects of Andrew Daneshgar's career or the meaning of his name resonate most with you? Share your thoughts in the comments below!

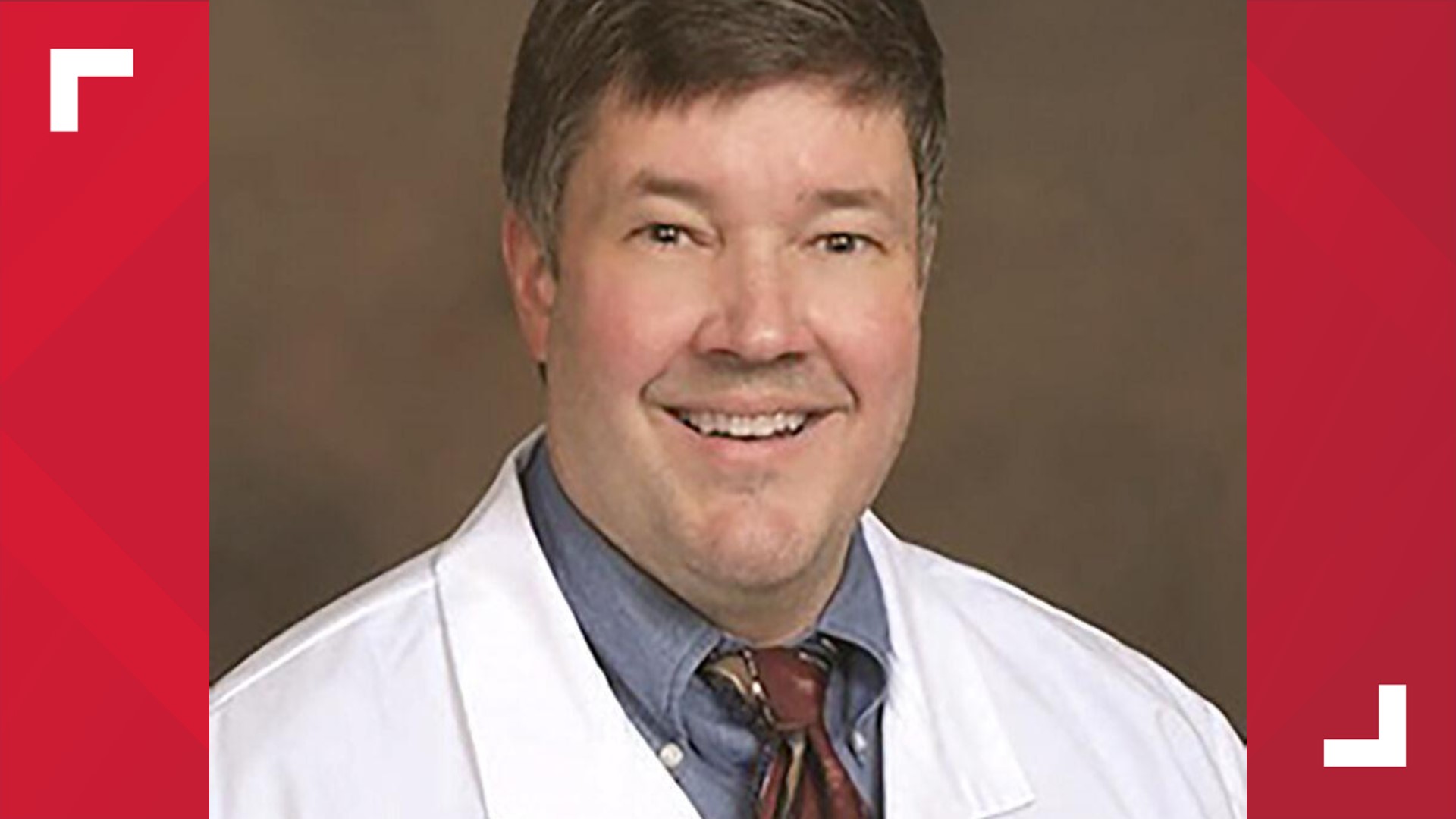

UPDATE: Longview doctor accused of inappropriately touching patients

Dr. Daneshgar | Team | Oral Surgery Center

Dr. Daneshgar | Team | Oral Surgery Center