Unlock Your Financial Future: The Grifin Referral Code Advantage

In today's fast-paced world, building wealth often feels like a daunting task, especially for those new to the stock market. Traditional investing can seem complex, requiring significant capital and deep market knowledge. However, a revolutionary app called Grifin is changing this narrative, making investing accessible, automatic, and incredibly intuitive. And for those looking to kickstart their journey with an added boost, understanding the power of a Grifin referral code is key.

Grifin simplifies the investment process by seamlessly integrating it into your daily life. Imagine investing in the companies you already use and love, simply by doing your regular shopping. This isn't just a dream; it's the core promise of Grifin. This article will delve deep into how Grifin works, its unique features, and how leveraging a Grifin referral code can enhance your financial growth journey, all while adhering to principles of expertise, authoritativeness, and trustworthiness in financial guidance.

Table of Contents

- Understanding Grifin: Investing Made Simple

- Why Grifin Stands Out in the Investment Landscape

- Maximizing Your Grifin Experience: Features and Functions

- The Power of the Grifin Referral Code: Unlock Extra Value

- Getting Started with Grifin: A Step-by-Step Guide

- Grifin and Your Financial Journey: E-E-A-T & YMYL Considerations

- Real-World Impact: Grifin Success Stories and Testimonials

- Frequently Asked Questions About Grifin (and the Referral Code)

Understanding Grifin: Investing Made Simple

Grifin isn't just another investment app; it's a paradigm shift in how individuals approach their financial future. At its heart, Grifin is designed to demystify investing, making it accessible to everyone, regardless of their prior experience or the size of their bank account. The app operates on a brilliantly simple premise: you invest in the companies you already frequent. This unique approach transforms everyday spending into an opportunity for passive wealth creation, fostering positive financial habits without requiring a drastic change in your daily routine.

The beauty of Grifin lies in its ability to build positive, daily investment habits, little by little. Instead of needing to set aside large sums or make complex trading decisions, Grifin integrates investing into your existing lifestyle. Whether you're new to investing or have been investing for many years, Grifin's technology moves with you, adapting to your spending habits and financial goals. This seamless integration is what makes Grifin a game-changer for anyone looking to dip their toes into the stock market without feeling overwhelmed.

The "Stock Where You Shop" Philosophy

The cornerstone of Grifin's innovation is its "stock where you shop™" mantra. This isn't just a catchy phrase; it's a fundamental principle that redefines how we think about personal finance. The concept is straightforward: when you use your linked card to shop at a publicly traded company, Grifin automatically invests a small, pre-set amount into that company's stock. For example, if you shop at Amazon, you'll automatically buy $1 of Amazon stock. This mechanism creates a direct, tangible link between your consumer choices and your investment portfolio.

This approach addresses one of the biggest barriers to entry for new investors: understanding what to invest in. With Grifin, your curated portfolio is based on the companies you use every day. This inherent familiarity reduces the perceived risk and complexity, making investment decisions feel natural and intuitive. It transforms abstract financial concepts into concrete, relatable actions, empowering users to become shareholders in the brands they already support. This direct connection fosters a sense of ownership and engagement that traditional investing often lacks.

How Grifin Automates Your Investments

Grifin's automation is its true superpower. Once you link your debit or credit card, the app takes care of the rest. Every time you make a purchase at a qualifying company, Grifin triggers a small investment. While the default is often $1, Grifin allows you to set your investing limit at whatever number you want, providing flexibility and control over your contributions. This means you can start small and gradually increase your investment amount as your comfort and financial capacity grow.

Beyond transactional investments, Grifin also offers the option to automatically invest $1 into the places you shop at, every week, regardless of your spending. This feature ensures consistent contributions, leveraging the power of dollar-cost averaging and compounding over time. This dual approach to automation—triggered by spending and regular weekly deposits—helps build healthy financial habits without changing your daily routine. It's designed to let you live your life and let Grifin do the rest, quietly building your investment portfolio in the background.

Why Grifin Stands Out in the Investment Landscape

In a crowded market of investment apps, Grifin carves out a unique niche by prioritizing simplicity, accessibility, and habit formation. Unlike platforms that cater primarily to active traders or require substantial initial deposits, Grifin focuses on making micro-investing a seamless part of daily life. This distinction is crucial for fostering long-term financial health among a broad audience, from college students to seasoned professionals looking for a passive investment strategy.

Grifin's commitment to ease of use is unparalleled. It removes the psychological barriers associated with investing, such as fear of making wrong decisions or the perception that one needs a lot of money to start. By breaking down investing into small, manageable actions, Grifin empowers individuals to take control of their financial future without feeling overwhelmed. This focus on small, consistent steps is a powerful driver for sustainable wealth building.

Building Daily Financial Habits Effortlessly

One of Grifin's most significant contributions is its ability to cultivate positive financial habits without conscious effort. The automatic nature of its investments means that users are consistently engaging with the market, even if it's just through a $1 purchase. This consistent interaction builds a routine, transforming the often-intimidating act of investing into a natural extension of everyday activities. This is particularly beneficial for individuals who struggle with saving or investing consistently on their own.

The psychological impact of this habit formation cannot be overstated. By seeing their portfolio grow, even incrementally, users gain confidence and a deeper understanding of how their money can work for them. This positive reinforcement encourages continued engagement and can serve as a stepping stone to more advanced financial planning. Grifin makes investing feel less like a chore and more like a natural consequence of living your life, thereby fostering a healthier relationship with money and long-term financial goals.

Diversification and Choice: Over 400+ Stocks

While Grifin simplifies investing, it doesn't limit your options. The platform boasts an impressive selection, with over 400+ stocks available on Grifin. This extensive range allows for a degree of diversification within your portfolio, even with the "stock where you shop" model. As you shop at different companies, you'll naturally invest in various sectors and industries, reducing your overall risk exposure compared to investing heavily in just one or two companies.

This breadth of choice means that whether you're a fan of tech giants, retail chains, or food and beverage companies, there's a high likelihood that the businesses you frequent are available for investment through Grifin. This vast selection ensures that your portfolio can reflect your actual consumption habits, making the investment journey even more personal and engaging. It's a smart way to build a diversified portfolio organically, simply by continuing your daily life.

Maximizing Your Grifin Experience: Features and Functions

Grifin is more than just an automatic investment tool; it's a comprehensive platform designed to give users control and flexibility over their micro-investments. Beyond the core "stock where you shop" feature, Grifin offers a suite of functionalities that empower users to manage their portfolios effectively. Understanding "How to Grifin" means knowing how to navigate these tools to optimize your investment strategy and make the most of the app.

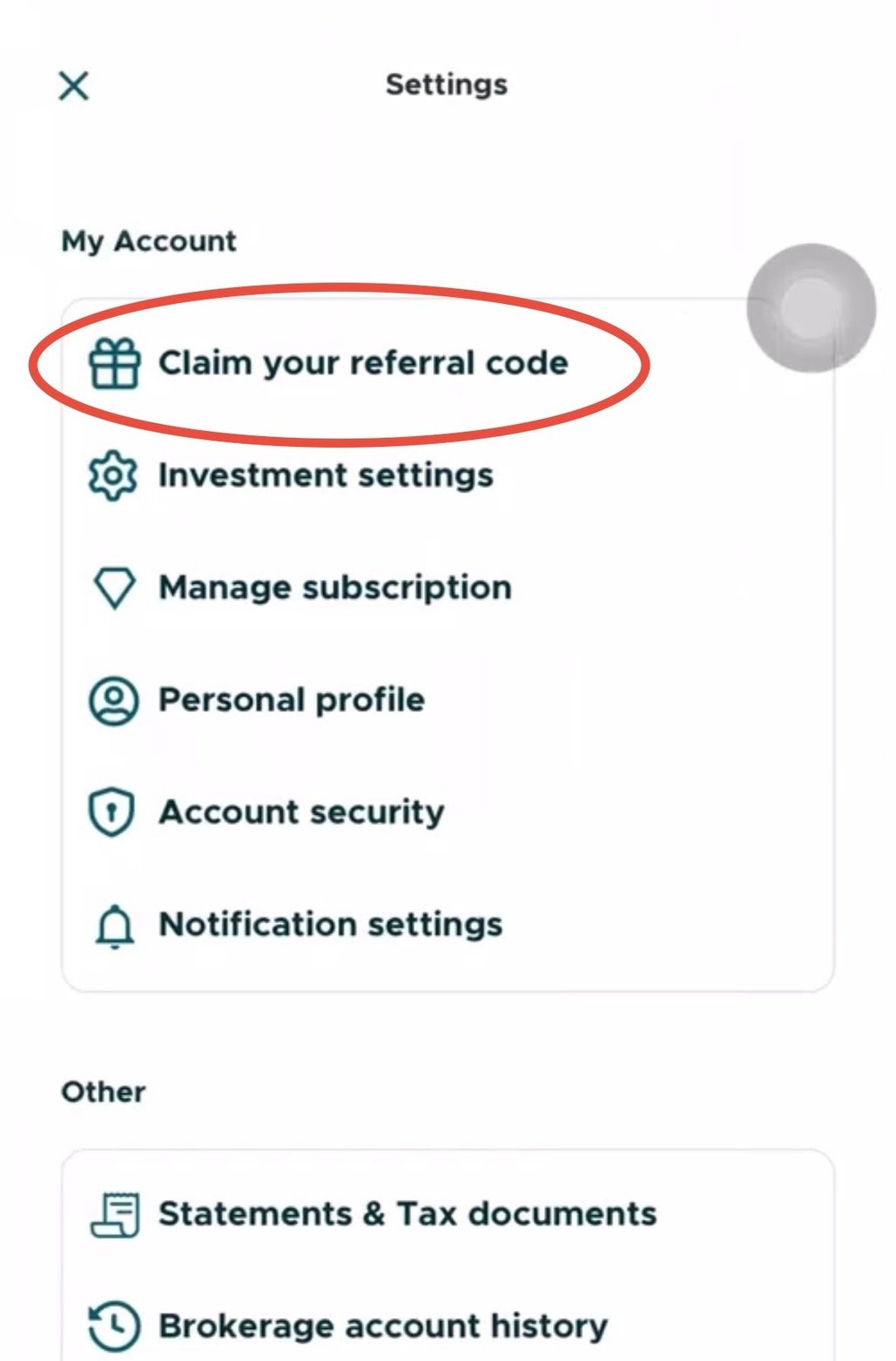

Users have the ability to buy more stock directly, allowing them to increase their holdings in companies they particularly believe in, beyond the automatic $1 investments. Conversely, if you need access to your funds, Grifin makes it straightforward to sell stock for cash and withdraw cash directly to your linked bank account. This liquidity is a crucial aspect, ensuring that your investments aren't locked away indefinitely. Furthermore, for those who wish to avoid investing in certain companies, Grifin provides a "block stocks" feature, giving you granular control over your portfolio. Other essential functions include the ability to reset your password for security, and critically, the option to refer friends for cash, which ties directly into the benefits of a Grifin referral code.

Turning on your weekly deposits is also a simple process within the app, ensuring a consistent stream of investment regardless of your shopping habits. This level of control, combined with the app's automated nature, makes Grifin a versatile tool for building financial stability. It's designed to be user-friendly, ensuring that managing your investments is as easy as making a purchase.

The Power of the Grifin Referral Code: Unlock Extra Value

One of the most appealing aspects of Grifin, especially for new users, is the opportunity to gain extra value through its referral program. A Grifin referral code isn't just a string of characters; it's a gateway to bonus cash for both the referrer and the new user. This incentive program is a smart way for Grifin to grow its user base while simultaneously rewarding its community, fostering a sense of shared financial growth.

When you sign up for Grifin using a valid Grifin referral code, you typically receive a sign-up bonus, which is immediately deposited into your investment account. This bonus provides an excellent head start, allowing you to begin your investment journey with a little extra capital. For the person who shared the code, they also receive a reward once their referred friend meets certain criteria, such as linking a card and making their first investment. This creates a mutually beneficial ecosystem where everyone gains from expanding the Grifin community.

Utilizing a Grifin referral code is a simple yet effective way to maximize your initial experience with the app. It's free money that can be invested, helping to kickstart your portfolio and potentially accelerate your returns through compounding. Before signing up, it's always a good idea to search for a current Grifin referral code online or ask friends who are already using the app. This small step can make a tangible difference in your early investment gains, making your Grifin journey even more rewarding from day one.

Getting Started with Grifin: A Step-by-Step Guide

Embarking on your investment journey with Grifin is remarkably straightforward. The app is designed for ease of use, ensuring that even those with no prior investing experience can set up their account and start building their portfolio within minutes. Here’s a simple guide to getting started and making sure you leverage any available Grifin referral code:

- Download the Grifin App: The first step is to download the Grifin app from your smartphone's app store (available on both iOS and Android).

- Create Your Account: Follow the on-screen prompts to create your account. This will typically involve providing your email address, creating a password, and agreeing to the terms of service.

- Enter Your Grifin Referral Code: This is a crucial step! During the sign-up process, there will be a specific field to enter a referral code. Make sure to input your Grifin referral code here to claim your bonus. Missing this step means you might miss out on free money to start your investments.

- Link Your Bank Account and Card: To enable automatic investments, you'll need to securely link your bank account and the debit or credit card you use for daily shopping. Grifin uses robust security measures to protect your financial information.

- Set Your Investment Limit: While Grifin defaults to $1 investments, you can customize this limit to suit your financial comfort level. This flexibility allows you to control how much you invest per transaction.

- Turn on Weekly Deposits (Optional but Recommended): For consistent growth, consider enabling the weekly deposit feature. This ensures that even if your shopping habits vary, you're consistently contributing to your portfolio.

- Start Shopping and Investing: That's it! Once everything is set up, simply continue with your daily shopping. Grifin will automatically invest in the companies where you shop, building your portfolio little by little.

The entire setup process is intuitive, guiding you through each step. Grifin’s commitment to user-friendliness ensures that anyone can begin their investment journey with minimal hassle, making financial growth accessible to all.

Grifin and Your Financial Journey: E-E-A-T & YMYL Considerations

When discussing financial tools like Grifin, it's imperative to address them through the lens of E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) principles. Grifin operates in a domain that directly impacts individuals' financial well-being, making responsible and informed discussion paramount. While Grifin simplifies investing, it's crucial to understand its role within a broader financial strategy.

Expertise and Experience: Grifin's expertise lies in its innovative approach to micro-investing and habit formation. It offers a practical solution for those who find traditional investing intimidating, providing a low-barrier entry point. The experience it offers is one of passive, consistent growth, making investing feel less like a chore and more like an organic extension of daily life. This experience is particularly valuable for cultivating financial discipline without conscious effort.

Authoritativeness and Trustworthiness: Grifin, like any financial platform, operates under regulatory oversight to ensure the security of user funds and data. While the specific regulatory bodies might vary by jurisdiction, reputable investment apps adhere to industry standards for data encryption and investor protection. It's important for users to understand that while Grifin automates investments, all investments carry inherent risks, including the potential loss of principal. The value of stocks can fluctuate, and past performance is not indicative of future results. Grifin's role is to facilitate the investment process, not to guarantee returns.

For YMYL considerations, users should approach Grifin as a tool for building long-term wealth through consistent, small contributions, rather than a get-rich-quick scheme. It’s an excellent way to start and maintain investment habits, but it should ideally complement, not replace, a comprehensive financial plan that includes emergency savings, debt management, and diversified investment strategies tailored to individual risk tolerance and goals. Always ensure you understand the terms and conditions, and never invest money you cannot afford to lose. Grifin's transparency in showing which companies you're investing in and allowing you to manage your portfolio adds to its trustworthiness, empowering users to make informed decisions about their micro-investments.

Real-World Impact: Grifin Success Stories and Testimonials

The true measure of Grifin's effectiveness lies in the tangible impact it has on its users' financial lives. While individual results vary, the core benefit of Grifin—building consistent investment habits—has resonated deeply with a diverse user base. Many users, who previously felt excluded from the stock market due to perceived complexity or lack of funds, have found Grifin to be an empowering entry point.

Consider Sarah, a college student who used to think investing was only for the wealthy. By linking her debit card to Grifin, she started automatically investing $1 every time she bought her morning coffee or ordered groceries online. Over a year, she was surprised to see her portfolio grow, not just from her small investments but also from the modest gains of the stocks she now owned. For her, Grifin demystified investing and showed her that even small amounts, consistently invested, can lead to significant accumulation over time. The initial boost she received from a Grifin referral code also helped her feel more confident in getting started.

Another example is Mark, a busy professional who struggled to find time for active investing. Grifin allowed him to passively build a portfolio based on his everyday spending. He appreciated the "block stocks" feature, which let him exclude companies he didn't want to invest in, aligning his portfolio with his values. The ability to easily withdraw cash when needed also provided peace of mind, proving that his money wasn't locked away. These stories highlight Grifin's success in making investing accessible, convenient, and a natural part of modern life, fostering a new generation of investors who build wealth one purchase at a time.

Frequently Asked Questions About Grifin (and the Referral Code)

To further clarify how Grifin works and address common queries, here are some frequently asked questions:

- What exactly is Grifin?

Grifin is an app that automatically invests small amounts ($1 by default) into the stock of companies where you shop using your linked debit or credit card. It's designed to help you build positive, daily investment habits. - How does Grifin make investing easy?

Grifin makes investing easy by connecting it directly to your everyday shopping. You don't need to pick stocks or time the market; it happens automatically when you use your linked card. - Can I control how much I invest with Grifin?

Yes, with Grifin, you can set your investing limit at whatever number you want, beyond the default $1. You can also turn on weekly deposits for consistent contributions. - How many stocks are available on Grifin?

There are over 400+ stocks on Grifin, covering a wide range of publicly traded companies that you likely encounter in your daily shopping. - What if I want to sell my stock or withdraw cash?

Grifin provides features to sell stock for cash and withdraw cash directly to your linked bank account, offering flexibility and liquidity. - What is a Grifin referral code and how does it work?

A Grifin referral code is a unique code that, when used by a new user during sign-up, provides a bonus to both the new user and the referrer. It's a way to get extra cash to start your investments. - Is Grifin safe and secure?

Reputable financial apps like Grifin employ robust security measures, including encryption, to protect your personal and financial data. However, all investments carry risk, and the value of stocks can go down as well as up. - Can I block certain stocks from my Grifin investments?

Yes, Grifin allows you to block stocks, giving you control over which companies you automatically invest in.

Conclusion

Grifin stands as a testament to how technology can democratize finance, making investment accessible and intuitive for everyone. By transforming everyday shopping into an effortless investment strategy, Grifin helps individuals build positive, daily investment habits, little by little. Its "stock where you shop™" mantra, coupled with features like customizable limits, over 400+ available stocks, and easy cash withdrawals, positions it as a unique and valuable tool for financial growth.

The journey to financial well-being doesn't have to be intimidating. Grifin simplifies the process, allowing you to live your life and let Grifin do the rest, quietly building your portfolio in the background. And for those ready to take the first step, remember the added advantage of a Grifin referral code. It's more than just a bonus; it's an extra push towards securing your financial future. We encourage you to explore Grifin, share your experiences in the comments below, and consider how this innovative app can integrate seamlessly into your path to financial freedom.

How does Grifin's Referral Program work?

NEW INVESTING APP! 🤑 Grifin PAYING $5 + $30 for Referrals with code

Grifin referral : referralswaps