Simplex Tax: Unveiling The Power Of Simplicity In Taxation

In the intricate world of finance and public policy, the idea of a "simplex tax" stands as a beacon of clarity, promising a departure from the often-bewildering complexity of traditional tax systems. While not a universally recognized term in the exact same vein as "income tax" or "sales tax," the concept it embodies—a fundamentally simple, straightforward, and easily understandable taxation framework—is a perennial aspiration for policymakers, economists, and taxpayers alike. This article delves deep into what a simplex tax truly means, exploring its potential benefits, inherent challenges, and why the pursuit of simplicity in taxation continues to captivate our collective imagination.

For many, the annual ritual of tax filing is synonymous with frustration, confusion, and the feeling of navigating an impenetrable labyrinth of rules, deductions, and exemptions. This pervasive sentiment fuels the ongoing debate about tax reform, often gravitating towards models that prioritize ease of understanding and administration. The "simplex tax" isn't just a theoretical construct; it represents a philosophical shift towards a system where the average citizen can grasp their obligations without needing an army of accountants or specialized software, fostering greater compliance, trust, and economic efficiency.

Table of Contents

- The Allure of Simplicity: What is a Simplex Tax?

- Why Simpler Taxes Matter: Benefits for Individuals and Businesses

- Historical Echoes: Past Attempts at Tax Simplification

- The Core Pillars of a Simplex Tax System

- Navigating the Hurdles: Challenges in Implementing a Simplex Tax

- Real-World Glimpses: Nations Embracing Simpler Tax Models

- The Economic Ripple Effect: Simplex Tax and Growth

- The Future of Taxation: Is a Simplex Tax the Way Forward?

The Allure of Simplicity: What is a Simplex Tax?

At its heart, a "simplex tax" system is one that prioritizes ease of understanding, compliance, and administration above all else. The term "simplex" itself, derived from Latin, means "simple" or "basic," often referring to a fundamental, irreducible component. In the context of taxation, this translates to a system stripped of convoluted rules, countless exemptions, and complex calculations that plague many modern tax codes. It's not about being "easy" in the sense of paying less tax, but rather "simple" in the sense of knowing exactly what you owe, why you owe it, and how to pay it without undue burden.

Imagine a tax system where you could, with minimal effort, calculate your own tax liability. This is the ideal that a simplex tax aims for. It contrasts sharply with complex systems that often require professional assistance, leading to significant compliance costs for both individuals and businesses. The appeal of such a system is universal: it promises to reduce administrative overhead for governments, free up valuable time and resources for taxpayers, and potentially foster greater economic activity by removing barriers to investment and entrepreneurship.

Unpacking the "Simplex" in Taxation

To truly understand the "simplex" in taxation, we must look beyond just a lower number of pages in the tax code. It encompasses several dimensions:

- Clarity: The rules are clear, unambiguous, and easily interpretable by the average person, not just legal or financial experts.

- Predictability: Tax outcomes are predictable. Individuals and businesses can reliably forecast their tax liabilities, which is crucial for financial planning and investment decisions.

- Minimal Loopholes: A simplex tax system aims to minimize or eliminate the myriad of deductions, credits, and special provisions that create loopholes, leading to perceived unfairness and encouraging tax avoidance.

- Efficiency in Compliance: The process of calculating, reporting, and paying taxes is streamlined, reducing the time and money spent on compliance.

- Broad Base, Low Rates: Often, simplicity is achieved by taxing a broader base of income or consumption at lower, more uniform rates, rather than taxing a narrow base at high, progressive rates with numerous exceptions.

The essence of a simplex tax is to make the tax system a transparent, predictable, and fair mechanism for revenue collection, rather than a tool for complex social engineering or a source of competitive advantage for those who can afford sophisticated tax planning.

Why Simpler Taxes Matter: Benefits for Individuals and Businesses

The pursuit of a simplex tax is driven by a compelling array of potential benefits that can positively impact an economy at various levels:

- Reduced Compliance Costs: This is perhaps the most immediate and tangible benefit. Complex tax codes force individuals and businesses to spend billions annually on tax preparation software, professional accountants, and legal advice. A simplex tax would drastically cut these costs, freeing up capital that can be invested, saved, or spent, stimulating economic activity.

- Increased Economic Efficiency: When tax rules are simple and transparent, economic decisions are less distorted by tax considerations. Businesses can focus on innovation and productivity rather than tax planning. Investment decisions are based on genuine economic merit rather than tax advantages.

- Enhanced Fairness and Equity: A complex tax code often disproportionately benefits those with the resources to exploit its intricacies. A simplex tax, with fewer loopholes and special provisions, can create a more level playing field, ensuring that everyone pays their fair share based on clear, understandable rules. This perception of fairness can also increase voluntary compliance.

- Improved Government Administration: For tax authorities, a simpler system means less need for complex audits, fewer disputes, and a more straightforward collection process. This reduces administrative overhead for the government, allowing resources to be reallocated to other public services.

- Greater Transparency and Accountability: When the tax system is simple, it's easier for citizens to understand how much revenue the government collects and from whom. This transparency can foster greater public trust and hold governments more accountable for their spending decisions.

- Stimulated Entrepreneurship and Growth: Small businesses and startups are particularly burdened by complex tax compliance. A simplex tax can lower the barrier to entry for new ventures, encouraging entrepreneurship and job creation. When businesses know their tax obligations clearly, they are more likely to expand and invest.

These benefits paint a compelling picture for the adoption of a simplex tax model, highlighting its potential to unlock economic potential and foster a more equitable society.

Historical Echoes: Past Attempts at Tax Simplification

The idea of a simplex tax is not new; it echoes through various historical attempts and theoretical proposals for tax reform. Throughout history, societies have grappled with the optimal way to fund public services, often swinging between highly complex and relatively simple systems. In modern times, several concepts have emerged as prominent examples of the drive towards simplification:

- The Flat Tax: Perhaps the most well-known proposal for tax simplification, a flat tax applies a single, uniform tax rate to all taxable income, regardless of the income level. Proponents argue it dramatically reduces complexity, encourages work and investment, and eliminates many loopholes. Countries like Russia, Estonia, and some Eastern European nations have implemented variations of a flat tax with varying degrees of success.

- The FairTax (Consumption Tax): This proposal advocates for replacing all federal income, payroll, gift, and estate taxes with a single national retail sales tax. The idea is that people are taxed on what they consume, not what they earn or save. It aims for radical simplification by shifting the tax burden to the point of sale, theoretically eliminating the need for complex income tax returns for most individuals.

- The "Postcard" Tax Return: While not a full system, the concept of a tax return so simple it could fit on a postcard (or a single page) has been a recurring theme in tax reform discussions in the United States. This reflects the desire to reduce the sheer volume and complexity of tax forms.

- Broadening the Tax Base: Many simplification efforts focus on reducing the number of deductions, credits, and exclusions that narrow the tax base. By taxing more income or consumption at lower rates, the system becomes less susceptible to manipulation and easier to administer.

These historical and theoretical examples demonstrate a consistent yearning for a tax system that is less burdensome and more transparent. While none have achieved perfect "simplex" status, they represent steps in that direction, highlighting the ongoing debate about how to balance simplicity with other societal goals.

The Core Pillars of a Simplex Tax System

While the exact design of a simplex tax can vary, certain fundamental principles underpin most proposals for radical tax simplification. These pillars form the bedrock upon which an understandable and efficient tax system can be built:

- Broad Tax Base: A simplex tax typically aims to tax a wide range of economic activity or income, minimizing exemptions and deductions. The broader the base, the lower the tax rate needed to generate the required revenue, and the fewer opportunities for tax avoidance.

- Low, Uniform Rates: Instead of multiple progressive tax brackets or varying rates for different types of income, a simplex tax often features one or very few tax rates. This significantly simplifies calculations and removes incentives to reclassify income to achieve a lower rate.

- Minimal Deductions and Exemptions: The proliferation of deductions and exemptions is a primary driver of tax code complexity. A simplex tax would drastically reduce these, perhaps retaining only a very basic personal allowance or standard deduction. This eliminates the need for extensive record-keeping and complex calculations.

- Clear Definitions: Taxable income, expenses, and other key terms are defined in a straightforward and unambiguous manner, leaving little room for interpretation or dispute.

- Simplified Filing Process: The actual process of reporting and paying taxes is designed to be as simple as possible, ideally allowing for pre-filled returns or minimal input from the taxpayer.

These pillars work in concert to create a system that is not only easier to navigate but also potentially more equitable and economically efficient. By removing the layers of complexity, a simplex tax can foster greater trust between citizens and their government.

The Promise of Fairness and Equity

One of the most compelling arguments for a simplex tax is its potential to enhance fairness and equity. In complex systems, "fairness" often becomes subjective, with different groups arguing over what constitutes an equitable distribution of the tax burden. A simplex tax addresses this by:

- Reducing Tax Avoidance: With fewer loopholes and special provisions, it becomes harder for individuals and corporations to legally reduce their tax liability through sophisticated planning. This means that everyone, regardless of their access to tax advisors, faces similar rules.

- Increasing Transparency: When the tax code is simple, it's easier for the public to understand who pays what and why. This transparency can expose instances of disproportionate burden or benefit, leading to more informed public debate and potentially greater political will for genuine equity.

- Leveling the Playing Field: Small businesses and lower-income individuals often bear a disproportionate share of compliance costs relative to their income. A simplex tax reduces these barriers, making the system more accessible and less burdensome for those with fewer resources.

While a simplex tax might not inherently guarantee a progressive outcome (where higher earners pay a larger percentage of their income in taxes), its transparency and reduced opportunities for avoidance can lead to a system that is perceived as more just by the general populace.

Navigating the Hurdles: Challenges in Implementing a Simplex Tax

Despite its undeniable appeal, implementing a truly simplex tax system is fraught with significant challenges, both political and economic. The very complexities that a simplex tax seeks to eliminate are often deeply embedded in existing social and economic structures, serving various policy goals:

- Political Resistance: Tax codes are often a patchwork of compromises and incentives designed to achieve specific social or economic objectives (e.g., encouraging homeownership through mortgage interest deductions, promoting charitable giving, supporting specific industries). Eliminating these provisions, even in the name of simplicity, inevitably creates winners and losers, leading to strong opposition from affected groups and their political advocates.

- Distributional Impacts: Any significant tax reform, especially one that broadens the base and lowers rates, will inevitably shift the tax burden. Some individuals or groups may end up paying more, while others pay less. Identifying these impacts and managing the political fallout is incredibly difficult.

- Loss of Policy Levers: Governments often use the tax code as a tool to influence behavior (e.g., tax credits for renewable energy, deductions for education expenses). A truly simplex tax would strip away many of these levers, forcing policymakers to find alternative, potentially less effective, ways to achieve desired social and economic outcomes.

- Transition Costs: Moving from a complex system to a simplex tax would involve massive transition costs for both the government (retooling tax agencies, updating IT systems) and taxpayers (learning new rules, adjusting financial planning).

- Defining "Income" or "Consumption": Even in a simple system, defining what constitutes taxable income or consumption can be complex, especially in a modern globalized economy with diverse income streams (e.g., digital assets, gig economy income, international transactions).

These challenges highlight that while the concept of a simplex tax is appealing, its practical implementation requires careful consideration of its broader societal implications and a willingness to confront entrenched interests.

The Tug-of-War: Balancing Simplicity with Social Goals

The core tension in tax reform often lies in the inherent conflict between simplicity and the desire to use the tax code to achieve specific social and economic goals. A highly progressive tax system, for example, aims to redistribute wealth and reduce income inequality, but often requires multiple tax brackets and complex rules. Similarly, providing targeted relief for specific groups (e.g., families with children, low-income workers) or incentivizing certain behaviors (e.g., saving for retirement, investing in research and development) inevitably adds layers of complexity.

- Progressivity vs. Flatness: A flat tax, a common simplex tax model, is often criticized for being regressive or less progressive than current systems, potentially placing a higher proportional burden on lower and middle-income earners. Balancing the desire for simplicity with the goal of progressive taxation is a major hurdle.

- Incentives vs. Neutrality: Every deduction or credit is an incentive. Eliminating them for simplicity means removing these incentives. Policymakers must decide if they are willing to forgo these tools for behavioral influence in exchange for a simpler system.

- Targeted Relief vs. Universal Rules: Modern tax codes often provide targeted relief for specific hardships or demographics. A simplex tax, by its nature, would likely replace these with more universal rules, which could negatively impact vulnerable populations unless offset by other social programs.

This tug-of-war illustrates that a truly simplex tax is not merely an accounting exercise; it's a profound political and social choice about the role of government and the distribution of economic burdens and benefits.

Real-World Glimpses: Nations Embracing Simpler Tax Models

While no nation has achieved a perfectly "simplex tax" system, several countries have implemented reforms aimed at significantly simplifying their tax codes, offering valuable lessons and insights:

- Estonia: Often cited as a pioneer in tax simplicity, Estonia adopted a flat income tax rate in the 1990s and has maintained a relatively simple and transparent system. It also has a unique corporate income tax system where profits are only taxed when distributed as dividends, not when earned, encouraging reinvestment. This simplicity is credited with fostering a dynamic business environment.

- New Zealand: Known for its broad-based Goods and Services Tax (GST) and a relatively simple income tax system with few deductions, New Zealand's tax code is often praised for its efficiency and ease of compliance compared to many other developed nations.

- Slovakia: Implemented a flat tax in the early 2000s, which significantly simplified its tax system and contributed to economic growth, though it later made some adjustments to introduce more progressivity.

- Hong Kong: Famous for its low, simple, and territorial tax system. It has very few tax types, low rates, and a clear distinction between local and foreign-sourced income, making it highly attractive for international business.

These examples demonstrate that significant simplification is achievable, though the specific approaches vary and are often tailored to the unique economic and political context of each nation. They show that a move towards a simplex tax is not just a theoretical dream but a tangible policy goal with real-world implications for economic performance and citizen well-being.

The Economic Ripple Effect: Simplex Tax and Growth

The potential economic benefits of a simplex tax extend far beyond mere compliance cost reductions. By fostering a more predictable and less burdensome tax environment, a simplified system can create a powerful ripple effect throughout the economy, stimulating growth and innovation:

- Increased Investment: When tax rules are clear and stable, businesses and individuals are more confident in making long-term investments. They can accurately forecast after-tax returns, reducing uncertainty and encouraging capital formation.

- Enhanced Entrepreneurship: The administrative burden of complex taxes can be a significant deterrent for startups and small businesses. A simplex tax lowers this barrier, making it easier for new ventures to form, grow, and create jobs.

- Reduced "Underground" Economy: When the tax system is perceived as fair and easy to comply with, there is less incentive for economic activity to move into the informal or "underground" economy. This brings more revenue into the formal system and expands the tax base.

- Improved International Competitiveness: Nations with simpler, more predictable tax systems are often more attractive to foreign direct investment and multinational corporations. This can lead to job creation and technology transfer.

- More Efficient Resource Allocation: Complex tax codes can distort economic decisions, leading resources to be allocated based on tax advantages rather than genuine economic productivity. A simplex tax promotes more neutral resource allocation, leading to greater overall economic efficiency.

In essence, a simplex tax can act as a catalyst for economic dynamism, by removing friction and allowing market forces to operate more freely and efficiently. The time and resources saved from navigating complex tax rules can be redirected towards productive activities, leading to broader economic prosperity.

The Future of Taxation: Is a Simplex Tax the Way Forward?

The aspiration for a simplex tax remains a powerful driving force in the ongoing global conversation about tax reform. As economies become more interconnected and digital, the complexities of existing tax systems are only likely to multiply. The rise of the gig economy, digital currencies, and cross-border e-commerce presents new challenges for traditional tax frameworks, making the need for simplicity and clarity even more pressing.

While a perfectly "simplex tax" might remain an elusive ideal due to the inherent trade-offs with other policy goals, the principles it embodies—transparency, efficiency, and ease of compliance—are increasingly recognized as crucial for a healthy and sustainable tax system. Future reforms are likely to continue moving in this direction, perhaps not through a radical overhaul, but through incremental steps that chip away at complexity, broaden tax bases, and streamline administrative processes.

For individuals and businesses, understanding the principles of a simplex tax is vital. It informs discussions about tax policy, empowers taxpayers to advocate for reforms, and helps in navigating the existing complexities. As the world evolves, the call for a tax system that is both effective in revenue generation and simple in its application will only grow louder, shaping the future of how we fund our societies.

What are your thoughts on the concept of a "simplex tax"? Do you believe a truly simple tax system is achievable, or is complexity an inevitable byproduct of modern economies and diverse policy goals? Share your perspectives in the comments below, and consider exploring other articles on our site for more insights into economic policy and financial planning.

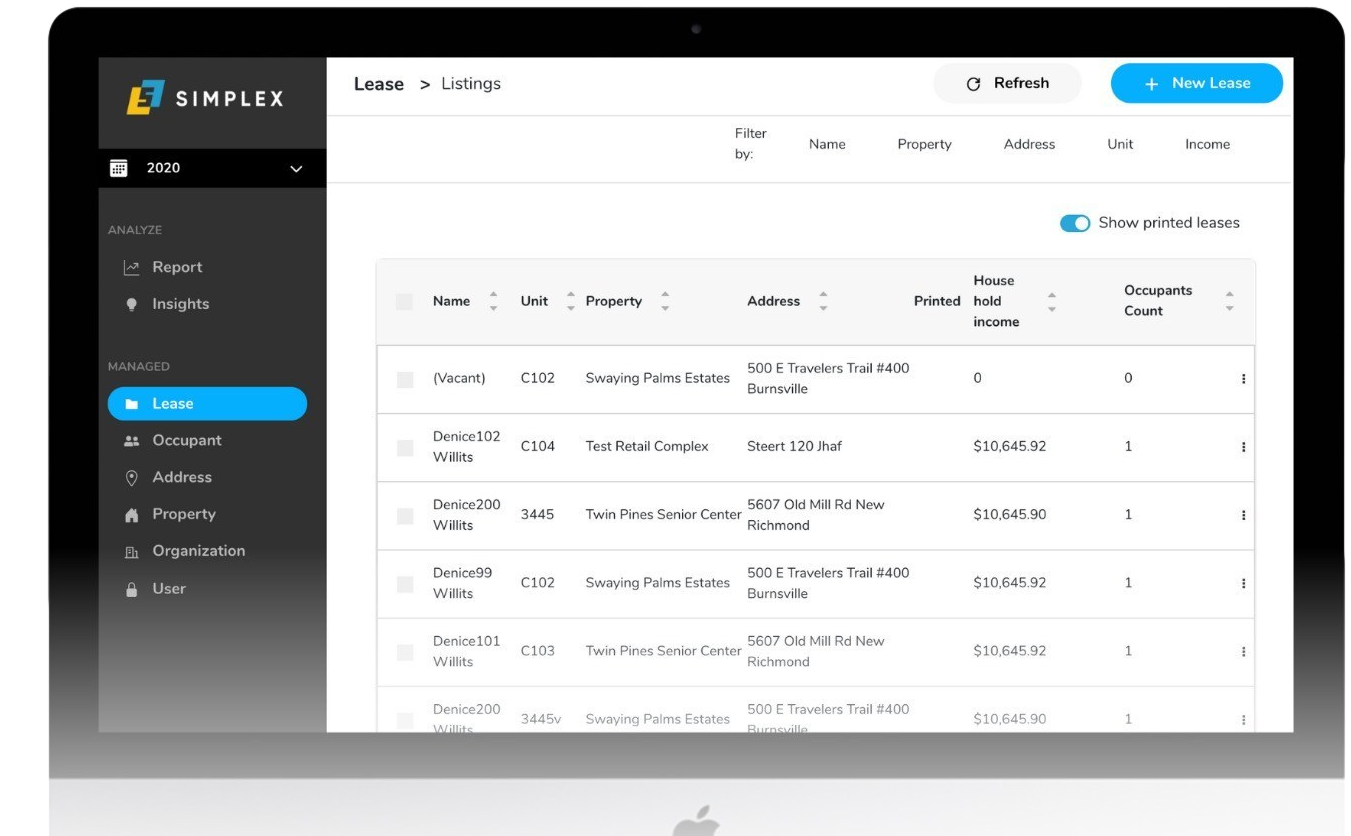

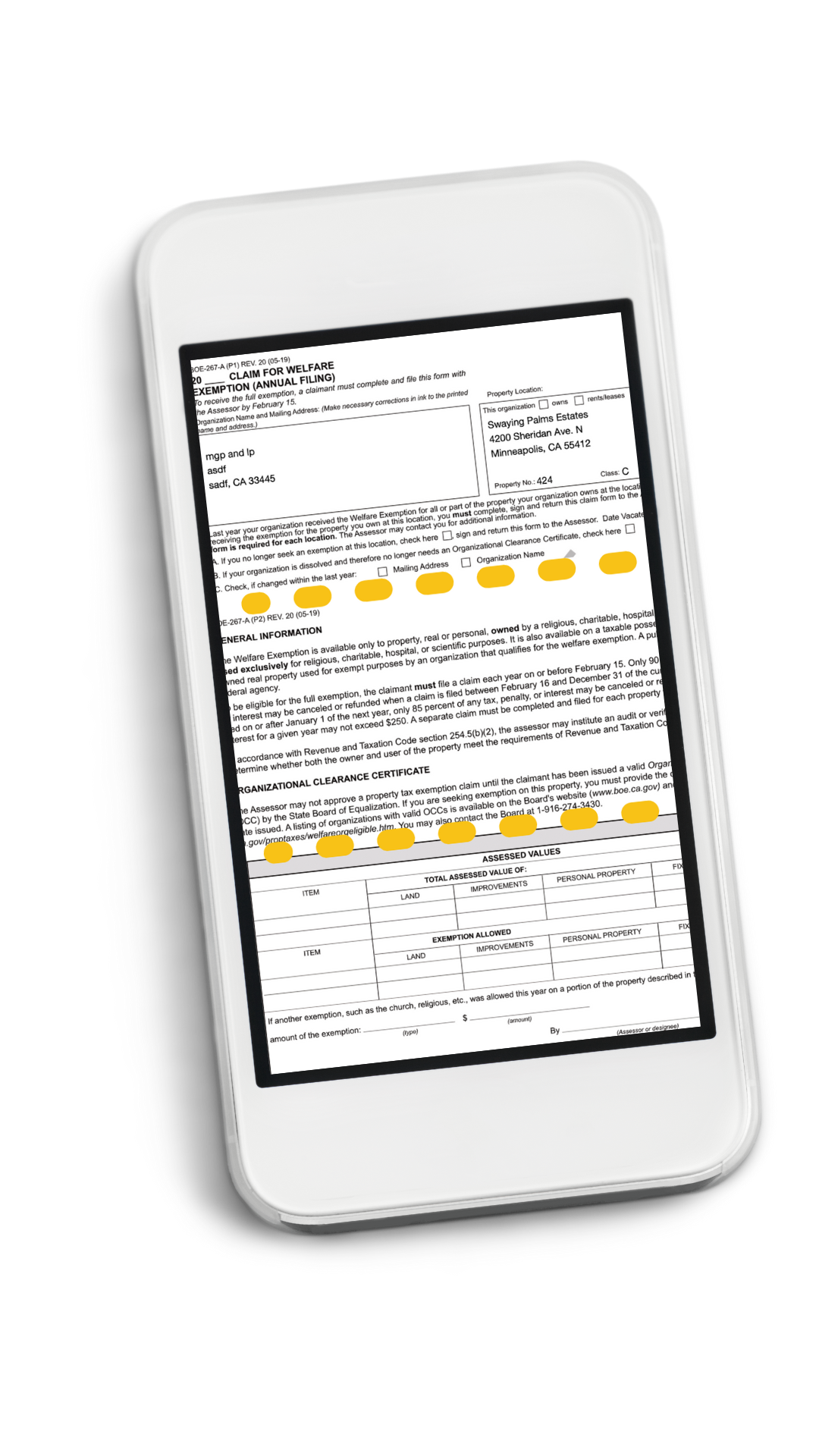

Simplex | Tax Welfare Exemption Filing for Housing Organizations

Simplex | Tax Welfare Exemption Filing for Housing Organizations

What is a Corporation Tax Return - Simplex Accounting