BIS Global Liquidity Indicators: Navigating Global Financial Health

**Understanding the pulse of the global financial system is paramount for policymakers, investors, and anyone concerned with economic stability. In an increasingly interconnected world, the flow of money across borders, particularly in foreign currencies, dictates market conditions and can signal potential vulnerabilities or opportunities. This is precisely where the BIS Global Liquidity Indicators (GLIs) come into play, offering an indispensable lens through which to observe and analyze the ease of financing in global markets.** These comprehensive indicators, meticulously compiled by the Bank for International Settlements (BIS), provide critical insights into the availability and cost of international funding, primarily focusing on foreign currency credit. They are not merely abstract figures but vital tools that illuminate the intricate web of global finance, helping to inform analysis of monetary and financial stability.

The significance of global liquidity cannot be overstated. It influences everything from corporate investment decisions to sovereign debt sustainability. When liquidity is abundant, financing is cheap and readily available, fostering economic growth. Conversely, a contraction in global liquidity can lead to tighter credit conditions, higher borrowing costs, and potentially trigger financial stress. By providing a detailed and timely overview of these dynamics, the BIS GLIs empower central banks and other national authorities to make informed decisions, develop robust policies, and ultimately improve the functioning of the global financial system. This article delves deep into what these indicators are, why they matter, and how they offer a crucial perspective on the ever-evolving landscape of international finance.

Table of Contents

- Understanding Global Liquidity: Why It Matters

- The Bank for International Settlements (BIS): A Pillar of Financial Stability

- What Are BIS Global Liquidity Indicators (GLIs)?

- Components of BIS Global Liquidity Indicators

- Interpreting BIS GLIs: Key Insights and Trends

- Navigating the BIS Data Platform: Accessing GLIs

- The Practical Implications of BIS Global Liquidity Indicators

- Beyond the Numbers: The Future of Global Liquidity Monitoring

Understanding Global Liquidity: Why It Matters

Global liquidity refers to the ease with which economic agents can obtain financing in international markets. It's essentially the fuel that powers the global economy, enabling cross-border trade, investment, and financial transactions. When this fuel is abundant, credit is cheap, and capital flows freely, supporting economic expansion. Conversely, a scarcity of global liquidity can choke off credit, leading to higher borrowing costs, reduced investment, and even financial crises. Think of it as the global financial system's circulatory system; if the blood flow (liquidity) is restricted, the entire body (economy) suffers. The importance of monitoring global liquidity became particularly evident during the 2008 global financial crisis. It highlighted how interconnected financial markets are and how a shortage of liquidity in one region or currency can quickly cascade across the globe. Post-crisis, there was a heightened recognition among central banks and international bodies of the need for better tools to track and understand these cross-border flows. This recognition directly led to the development and refinement of comprehensive indicators, with the Bank for International Settlements playing a pivotal role. The focus is often on foreign currency credit, as these flows are particularly sensitive to global market conditions and can have significant implications for countries that borrow heavily in currencies other than their own. Understanding these dynamics is not just an academic exercise; it is crucial for maintaining financial stability and preventing future crises.The Bank for International Settlements (BIS): A Pillar of Financial Stability

The Bank for International Settlements (BIS) is often referred to as the "bank for central banks." Established in 1930, it serves as a forum for international monetary and financial cooperation, a bank for central banks, and a center for economic and monetary research. Its primary mission is to support central banks' pursuit of monetary and financial stability, fostering international cooperation in those areas. The BIS achieves this through various means, including facilitating dialogue among central bankers, conducting research, and compiling crucial financial statistics that inform policy decisions worldwide. The BIS's unique position at the heart of the global financial system, coupled with its close collaboration with central banks and other national authorities, makes it an authoritative source for understanding global financial trends. Its work underpins much of the international regulatory framework, including the Basel Accords on banking supervision. When it comes to global liquidity, the BIS is unparalleled in its ability to collect, process, and disseminate the detailed data necessary for a comprehensive assessment. The BIS Global Liquidity Indicators are a prime example of this commitment to providing public goods that enhance financial system functioning.The BIS Innovation Hub and Its Role

In recent years, the BIS has further solidified its commitment to innovation through the establishment of the BIS Innovation Hub. This initiative is designed to explore new technologies that can improve the functioning of the financial system and support central banks in their evolving roles. The Innovation Hub develops public goods in the technology space, ranging from central bank digital currencies (CBDCs) to new ways of analyzing financial data. While not directly compiling the GLIs, the Hub's work indirectly contributes to the broader mission of enhancing financial stability by exploring how technology can provide better insights and more efficient processes for monitoring and managing global financial flows. Its centers around the globe, from Singapore to London, ensure a global perspective on financial innovation.BIS Statistics: A Foundation for Analysis

At the core of the BIS's analytical capabilities lies its robust statistical framework. BIS statistics, compiled in cooperation with central banks and other national authorities, are designed to inform analysis of monetary and financial stability and global liquidity. These statistics are not merely raw numbers; they are meticulously collected, harmonized, and presented to provide a consistent and reliable picture of international financial markets. The Bank for International Settlements provides a wide array of economic and financial indicators, including banking statistics, debt security statistics, derivative statistics, and, crucially, global liquidity data. This comprehensive statistical base allows for a granular understanding of cross-border financial exposures and funding conditions, making the BIS Global Liquidity Indicators particularly robust and authoritative.What Are BIS Global Liquidity Indicators (GLIs)?

The BIS Global Liquidity Indicators (GLIs) represent a comprehensive set of metrics designed to assess the ease of financing in global markets. They provide a unique and holistic view of cross-border credit, distinguishing between various types of liquidity. Specifically, this BIS report presents a comprehensive set of GLIs to assess the ease of financing in global markets. It distinguishes between official liquidity (provided by central banks) and market liquidity (provided by private financial institutions). The main focus of these indicators is on foreign currency credit, which refers to credit denominated in currencies other than the borrower's domestic currency. This focus is critical because foreign currency funding often involves different risks and dynamics compared to domestic currency funding. The GLIs track credit denominated in the three major international currencies: the US dollar, the euro, and the Japanese yen. By focusing on these key currencies, the BIS captures the vast majority of cross-border lending and borrowing activity that impacts global financial stability. The indicators cover a broad range of financial instruments and market participants, offering a multi-faceted perspective on global liquidity conditions. They are invaluable for understanding shifts in global funding patterns, identifying potential vulnerabilities, and assessing the resilience of the international financial system.Components of BIS Global Liquidity Indicators

The comprehensive nature of the BIS Global Liquidity Indicators stems from their inclusion of various credit channels and financial instruments. The bank's global liquidity indicators, which include both loan activity and international bond markets, provide a holistic view of how credit is extended across borders. This dual focus ensures that the indicators capture the full spectrum of cross-border funding, whether it's through direct bank lending or the issuance of debt securities in international capital markets.Foreign Currency Credit: The Core Focus

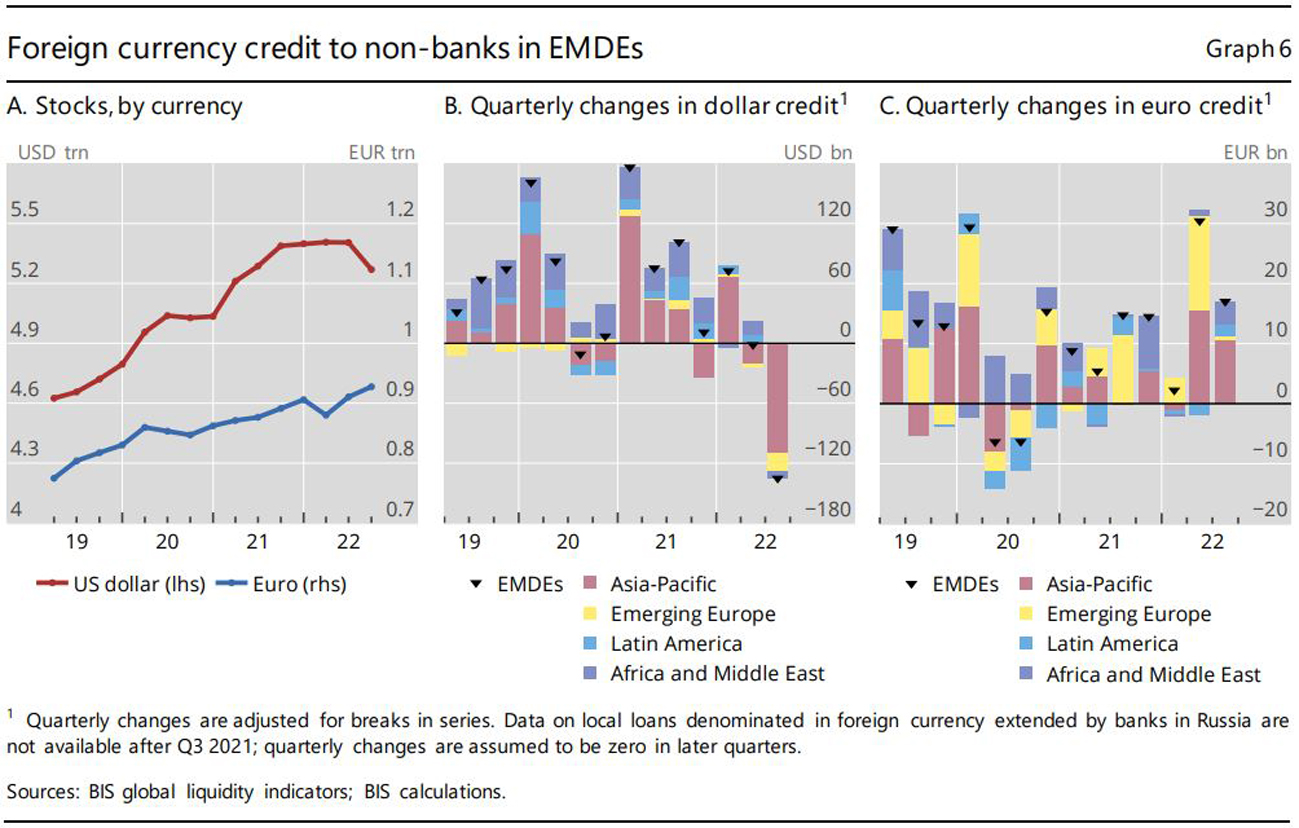

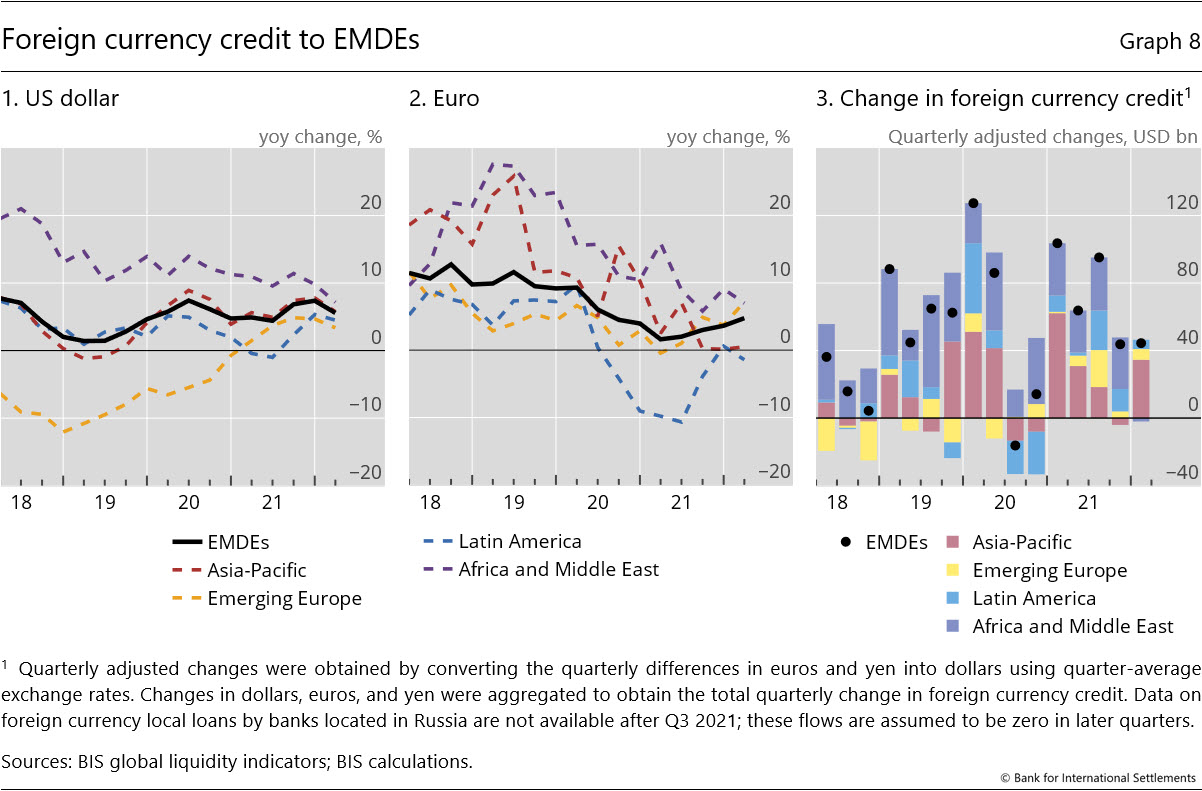

As mentioned, the main focus is on foreign currency credit, i.e., credit denominated in a currency other than the borrower's domestic currency. This distinction is crucial because foreign currency funding exposes borrowers to exchange rate risks and can be more volatile, especially during periods of global financial stress. For instance, a company in an emerging market borrowing in US dollars faces higher repayment costs if its local currency depreciates against the dollar. The BIS breaks down this foreign currency credit by type of claim and residence of borrower, providing granular detail on who is borrowing what, from whom, and in which currency. This level of detail allows analysts to pinpoint specific areas of vulnerability or growth in cross-border lending.Delving into Loan Activity and International Bond Markets

The GLIs meticulously track two primary channels of foreign currency credit:- Bank Loans: This component covers cross-border lending by banks, often referred to as international bank loans. These loans are a significant source of funding for corporations, financial institutions, and even sovereign entities globally. The indicators track changes in bank lending activity, which can reveal shifts in banks' risk appetite or funding conditions. For example, the contraction in dollar credit mainly reflected a drop in bank loans during certain periods, highlighting the sensitivity of this channel to global financial sentiment.

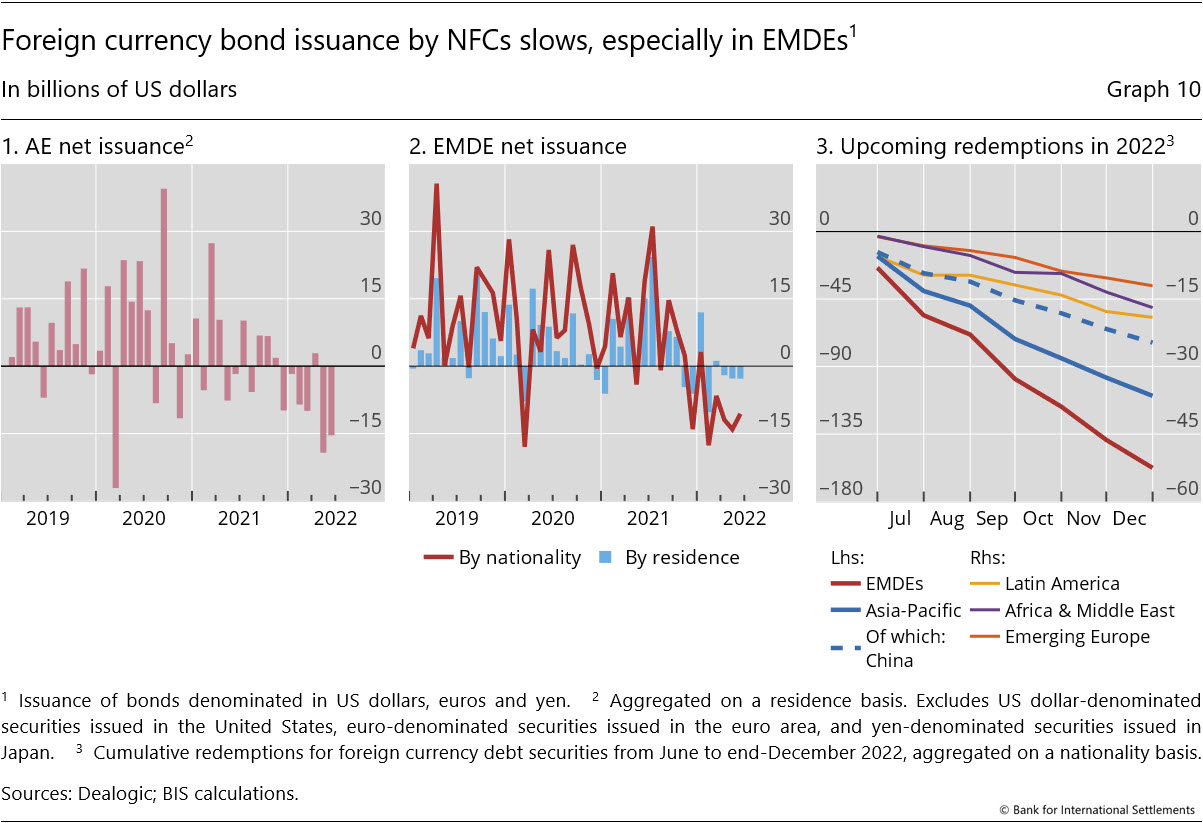

- International Bond Markets: This segment captures the issuance of debt securities (bonds) in international markets. Companies and governments often issue bonds in foreign currencies to tap into broader investor bases or secure lower borrowing costs. The GLIs monitor the volume and trends in these bond issuances, providing insights into investor demand for different types of debt and the overall ease of accessing capital markets. While bank lending declined slightly at times, international bond issuance might show different trends, reflecting a diversification of funding sources.

Interpreting BIS GLIs: Key Insights and Trends

Interpreting the BIS Global Liquidity Indicators goes beyond simply looking at the aggregate numbers. It involves understanding the underlying trends, regional shifts, and the interplay between different types of credit. The GLIs are designed to inform analysis of financial stability and international monetary dynamics, providing crucial context for economic assessments. They reveal patterns in cross-border lending and borrowing that might not be apparent from domestic financial data alone. For instance, the indicators can show whether overall global liquidity is expanding or contracting, and whether this is driven by bank loans, bond issuance, or both. They also highlight which currencies are most in demand for international borrowing and how this demand changes over time. Such insights are vital for central banks to anticipate potential funding pressures or excesses in their respective economies. The data can be filtered and customized to focus on specific breakdowns or measures of interest, allowing for highly targeted analysis.The Rising Share of EMDEs: Africa and the Middle East

One of the significant insights revealed by the BIS Global Liquidity Indicators is the evolving geographical distribution of foreign currency credit. For example, the GLIs reveal that the share of Africa and the Middle East in dollar and euro credit to emerging market and developing economies (EMDEs) has risen considerably over the past decade. This trend signifies increased financial integration of these regions into the global financial system and their growing reliance on foreign currency funding. While this can facilitate economic development, it also exposes these economies to greater exchange rate and refinancing risks, especially if global liquidity conditions tighten. Monitoring such shifts is critical for understanding where new vulnerabilities might be emerging in the global financial landscape. The data allows for a granular view, showing breakdowns by residence of borrower, which helps in identifying these regional concentrations.Navigating the BIS Data Platform: Accessing GLIs

The Bank for International Settlements doesn't just compile data; it makes it accessible to the public and researchers through its comprehensive online data platform. This platform is designed for ease of use, allowing users to explore the vast array of economic and financial indicators, including the BIS Global Liquidity Indicators. To gain quick insights, users can utilize dashboards and tables. These interactive tools allow for dynamic exploration of the data. You may interact with the available filters, for instance, to focus on breakdowns or measures of interest. For more detailed analysis, users can refine their selection by specifying the filter options, such as currency, type of claim, residence of borrower, or specific time periods. Once filters are applied, users can view their data selection as a list of time series, which is ideal for tracking trends over time. Alternatively, you can switch to table view and further customise the layout and settings, allowing for direct comparison of different data points. The flexibility of the platform ensures that both general readers and specialized researchers can extract the information most relevant to their needs. The availability of these tools underscores the BIS's commitment to transparency and to providing public goods that support informed decision-making.The Practical Implications of BIS Global Liquidity Indicators

The practical implications of the BIS Global Liquidity Indicators are far-reaching, affecting various stakeholders across the financial ecosystem. For central banks and financial regulators, these indicators are an indispensable tool for macroprudential policy. By monitoring the GLIs, authorities can identify potential build-ups of foreign currency debt, assess vulnerabilities to global financial shocks, and implement measures to mitigate risks before they escalate into systemic crises. For example, if the GLIs signal a rapid increase in dollar-denominated credit to domestic entities, central banks might consider tightening capital controls or increasing foreign exchange reserves to cushion against sudden capital outflows. For investors and financial institutions, the GLIs offer crucial insights into market conditions. A tightening of global liquidity, as indicated by the GLIs, could signal higher borrowing costs, reduced availability of funds, and potentially lower returns on riskier assets. Conversely, an expansion of liquidity might suggest a more favorable environment for investment and credit growth. Understanding these trends can inform portfolio allocation decisions, risk management strategies, and hedging activities. For multinational corporations, the GLIs provide a backdrop for assessing the cost and availability of cross-border financing for their operations and investments. Furthermore, academic researchers and economists rely on these comprehensive statistics to conduct in-depth studies on international finance, capital flows, and financial stability. The data compiled by the BIS, including the GLIs, forms the bedrock for much of the empirical research in these fields, contributing to a deeper theoretical and practical understanding of how the global financial system operates. The publications featured on the BIS website, including working papers and articles from BIS Quarterly Reviews, often leverage these indicators to present cutting-edge analysis and policy recommendations.Beyond the Numbers: The Future of Global Liquidity Monitoring

While the BIS Global Liquidity Indicators already provide a robust framework for understanding cross-border credit, the landscape of global finance is constantly evolving. New financial instruments, technologies, and market participants emerge, necessitating continuous adaptation in how liquidity is monitored. The BIS, through its ongoing research and the work of its Innovation Hub, remains at the forefront of these developments, exploring how to enhance the granularity and timeliness of its data. Future advancements might involve leveraging big data analytics and artificial intelligence to process even larger volumes of transactional data, providing real-time insights into liquidity flows. The increasing interconnectedness of digital financial systems and the potential rise of central bank digital currencies (CBDCs) could also introduce new dimensions to global liquidity, requiring innovative approaches to measurement and analysis. The BIS's commitment to compiling comprehensive statistics, in cooperation with central banks and other national authorities, ensures that these indicators will continue to be a vital public good, adapting to new challenges and supporting the stability of the international monetary and financial system. The main focus will undoubtedly remain on foreign currency credit, given its systemic importance, but the tools and methodologies used to track it will likely become even more sophisticated.Conclusion

The BIS Global Liquidity Indicators stand as an indispensable resource for anyone seeking to understand the intricate dynamics of global finance. By meticulously tracking foreign currency credit, encompassing both bank loans and international bond markets, the BIS provides a unique and authoritative perspective on the ease of financing across borders. These indicators are not just statistical curiosities; they are vital tools that inform central bank policies, guide investment decisions, and ultimately contribute to the stability of the international financial system. From revealing the rising financial integration of emerging markets like Africa and the Middle East to signaling potential contractions in dollar credit, the GLIs offer insights that are crucial for navigating an increasingly complex global economy. As the financial world continues to evolve, the importance of robust, comprehensive, and timely data on global liquidity will only grow. The Bank for International Settlements, through its dedication to collaboration, research, and innovation, ensures that these critical indicators remain at the forefront of financial analysis. We encourage you to explore the BIS's data platform, delve into the GLIs, and leverage these powerful insights to deepen your understanding of global financial health. What are your thoughts on the impact of global liquidity on your investments or business? Share your perspectives in the comments below, and consider exploring other articles on our site for more insights into financial markets and economic trends.

BIS global liquidity indicators at end-September 2022

BIS international banking statistics and global liquidity indicators at

BIS global liquidity indicators at end-March 2022